North America's most influential banking and payments event

September 15-16 2025 | The Radisson Blu Aqua Hotel, Chicago

Designed by banks, for banks.

This September, 800+ industry leaders from the USA and Canada will gather in Chicago to shape the future of banking

and payments in North America.

Be at the epicenter of transformation and position yourself at the forefront of change,

where ideas turn into action. If you’re looking for high impact and high ROI networking, this is the place to be.

2025 Conference Speakers

Manny Tocco

Kelly Dearwester

Ana Climente

Dontá Wilson

Ben Hoffman

Lizzie Pine

Steve Bugg

Jo Jagadish

“If you’re serious about banking and payments transformation, MoneyLIVE North America is a must-attend event. It provides unparalleled insights and high-impact networking.”

VP Technology Transformation, USAA

2025 AGENDA AT A GLANCE

Take a look at the hot topics at 2025's payments and banking event.

Day 1

____

STAGE 1

Building a digital-first bank

Redefining the customer experience in modern banking | Prioritizing digital transformation for enterprise success

Building a digital bank from scratch: the lessons learned | Innovation-ready banking: keeping ahead of the curve

STAGE 1

Digital Banking CX

Digital self-service banking

Creating a truly omnichannel customer experience

STAGE 2

Digital payments innovation

Shaking up the cards landscape

The future of digital wallet and P2P payments

Modernizing payment operations for digital payments

STAGE 3

Counter fraud: emerging trends

Staying ahead of fraud risks and trends

Increasing efficiency in counter fraud

Keeping pace with real-time payments fraud

STAGE 1

Customer engagement and loyalty

Customer-driven banking

Loyalty and rewards

Delivering personalized communications

Building data maturity for personalization

STAGE 2

Corporate payment innovation

Streamlining cross-border payments for corporates

Readying corporate clients for real-time payments

Simplifying corporate payments and payouts

STAGE 3

KYC, identity and AI

Staying ahead of financial crime risks in a digital era

Building robust KYC and KYB practices

Leveraging AI and advanced analytics for fraud detection

STAGE 1

Operational optimization

Reimagining traditional banking

Core banking modernization

Digital operational resilience and cybersecurity today

Operational optimization

STAGE 2

Lending and credit risk strategy

Economic outlook and the consumer lending market

Mortgage product innovation

Innovating in credit risk modeling

Driving innovation and efficiencies across the lending lifecycle

The Official After Party

Day 2

____

STAGE 1

The AI-enabled bank

The AI-enabled workforce: empowering employees effectively | Leveraging AI-decisioning to enhance business banking

AI assistants: reimagining the future of customer support | The AI-enabled bank: strategies for implementation and governance

STAGE 1

Open banking business models

The open banking rule

Seizing the open opportunities

Open banking business models

STAGE 2

Business banking innovation

Delivering competitive corporate CX

Achieving seamless and secure corporate onboarding

Enhancing digital banking for businesses

STAGE 3

Digital transformation workshop

Modernizing for members: a credit union transformation journey

Group discussion

STAGE 1

Partnerships in the API economy

Identifying FinTech growth areas: a VC perspective | BaaS business models: developing a winning proposition

Embedded finance: distribution strategy in the API economy

End of conference

“Flawlessly executed experience that provided me with a wealth of knowledge, networking opportunities, and relevant insights that are immediately actionable.”

VP Customer Strategy, Regions Bank

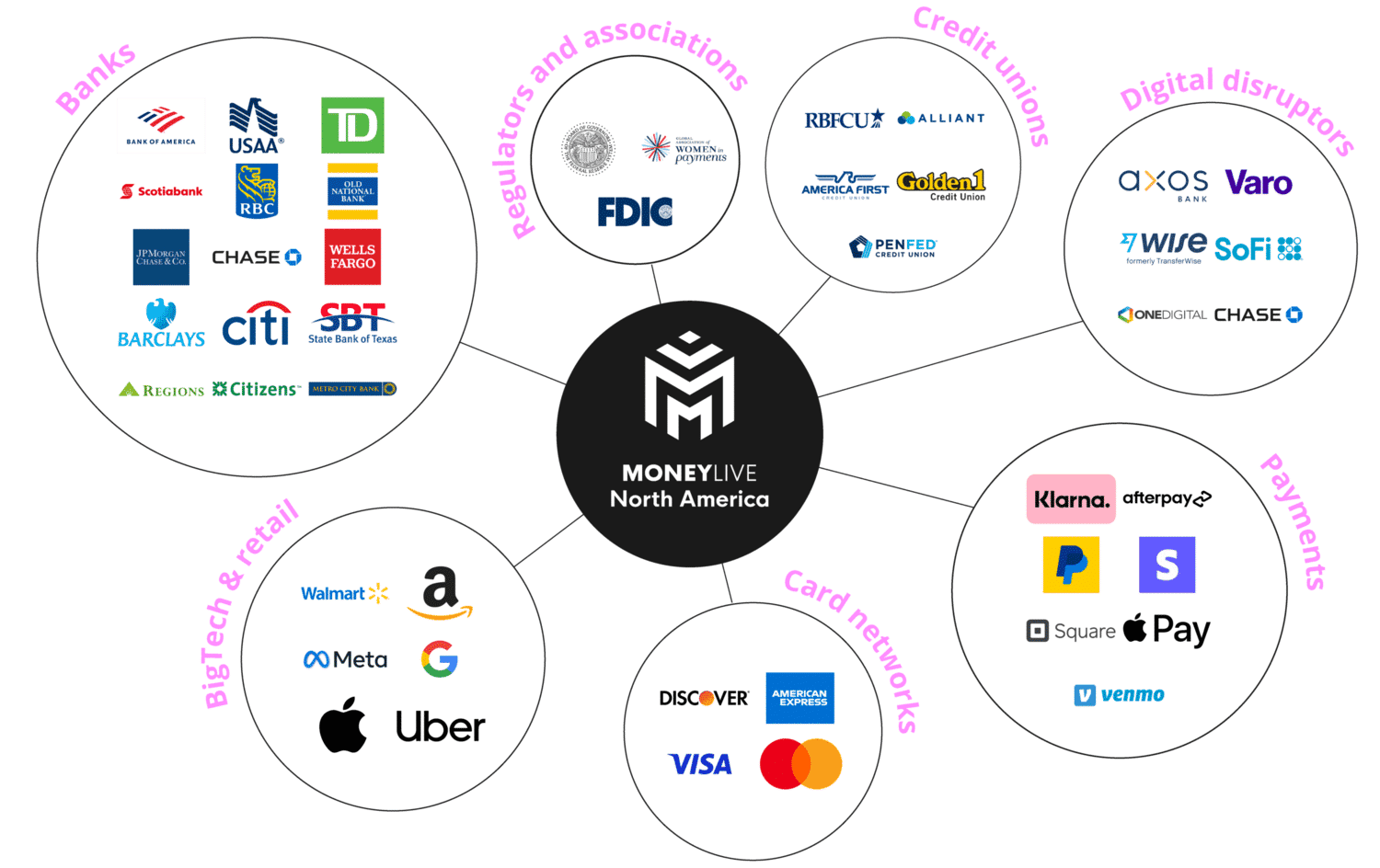

Who Attends

Our banking conference unites America's best and brightest to network and connect.

60%

C-level, Director, VP or

Head-of level

60%

Financial institutions

“MoneyLIVE North America works very closely with its clients and successfully delivers key 121 meetings with senior decision makers at large financial institutions. Our metrics and ROI following the event have been excellent.”

Senior Director, Global Field Marketing, IDVerse

Sponsorship Options

Explore options for sponsoring our banking conference

Thought leadership

Taking part in a fireside chat, fielding a chair or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

Why sponsor?

MoneyLIVE North America brings together key stakeholders from across consumer banking and payments.

As a solutions provider, you will find that MoneyLIVE North America is the place where you can connect with senior decision makers from the biggest banks.

There are a range of ways to be involved with our banking conference, from thought leadership sessions to hosting private events.

Don’t just take our word for it!

Here’s what our MoneyLIVE North America 2024 sponsors had to say…

2025 Conference Sponsors

We are proud to partner with leading lights across the global banking and payments sector. If you provide solutions to banks or the FinTech ecosystem, this is your best opportunity to connect with 800+ senior banking professionals all under one roof.

Headline Sponsor

Platinum Sponsor

Amazon Web Services

Gold Sponsors

Feedzai

GFT

Infosys

Personetics

Publicis Sapient

Silver Sponsors

Backbase

Bronze

More from MoneyLIVE north america

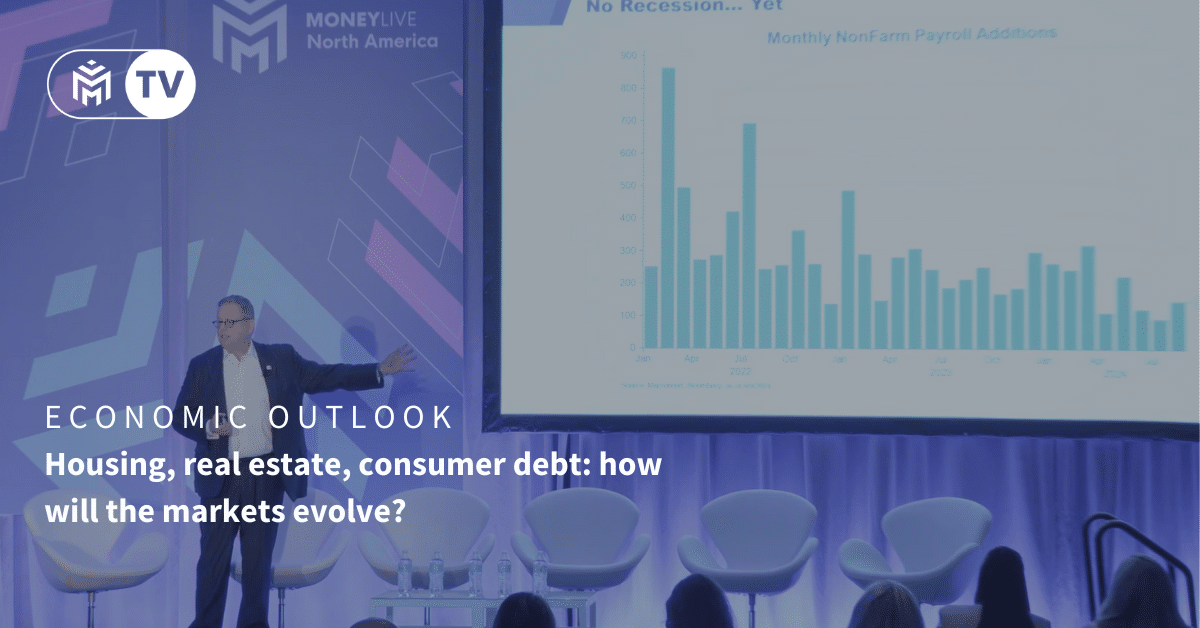

Housing, real estate, consumer debt: how will the markets evolve?

Jeffrey Korzenik, Chief Economist, Fifth Third Bank

Filmed onsite at MoneyLIVE North America 2024, now available to stream

Customer-driven banking: setting the pace of innovation

Mark Valentino, President and Head of Business Banking, Citizens

Filmed onsite at MoneyLIVE North America 2024, now available to stream