Forging the future

Europe's most senior banking and payments conference

9-10 March 2026 | Business Design Centre, London

Unrivalled seniority.

Unmatched impact.

MoneyLIVE Summit sets the agenda for the future of banking and payments.

Hosted in the FinTech capital of the world, this is the global payments and banking event uniting industry leaders at the top of their game.

“A must-attend event that never disappoints.”

Saif Malik, Chief Executive Officer

Standard Chartered UK

Unrivalled seniority.

Unmatched impact.

MoneyLIVE Summit sets the agenda for the future of banking and payments.

Hosted in the FinTech capital of the world, this is the global payments and banking event uniting industry leaders at the top of their game.

HEADLINE SPEAKERS

Check out our supercharged speaker line-up for 2026's banking event.

For live announcements, follow us on LinkedIn.

Vim Maru

Saif Malik

Saif Malik is the UK Chief Executive Officer and Head of Client Coverage. In this role, he leads the UK and the management and development of the corporate and financial institution client relationships in the UK. Saif joined Standard Chartered in 2006 and has held various leadership roles across the client businesses including, Co-Head of Wholesale Banking with Standard Chartered Nigeria, Head of Corporate & Institutional Clients with Standard Chartered Malaysia, Regional Co-Head of Global Banking for Africa & Middle East, and Global Head our multinational corporate business (Global Subsidiaries). Before he joined Standard Chartered, Saif held roles with Barclays Bank Tanzania, Barclays Bank Zambia, as well as a brief stint with the Central Bank of Zambia. Saif is a passionate advocate for a sustainable, diverse and an inclusive global future. He possesses a wealth of Banking and Finance experience in the areas of sales & business development, marketing and corporate credit. Saif holds a Bachelor of Arts in Economics and a Master of Arts in International Business, both from the University of Kentucky, USA.

Marnix van Stiphout

Amit Thawani

Mark Brandt

Bianca Zwart

William O’ Carroll

Simon Taylor

Divya Bhardwaj

Kasper Tjørntved Davidsen

Who attends

This is the banking and payments conference where you’ll make game changing connections.

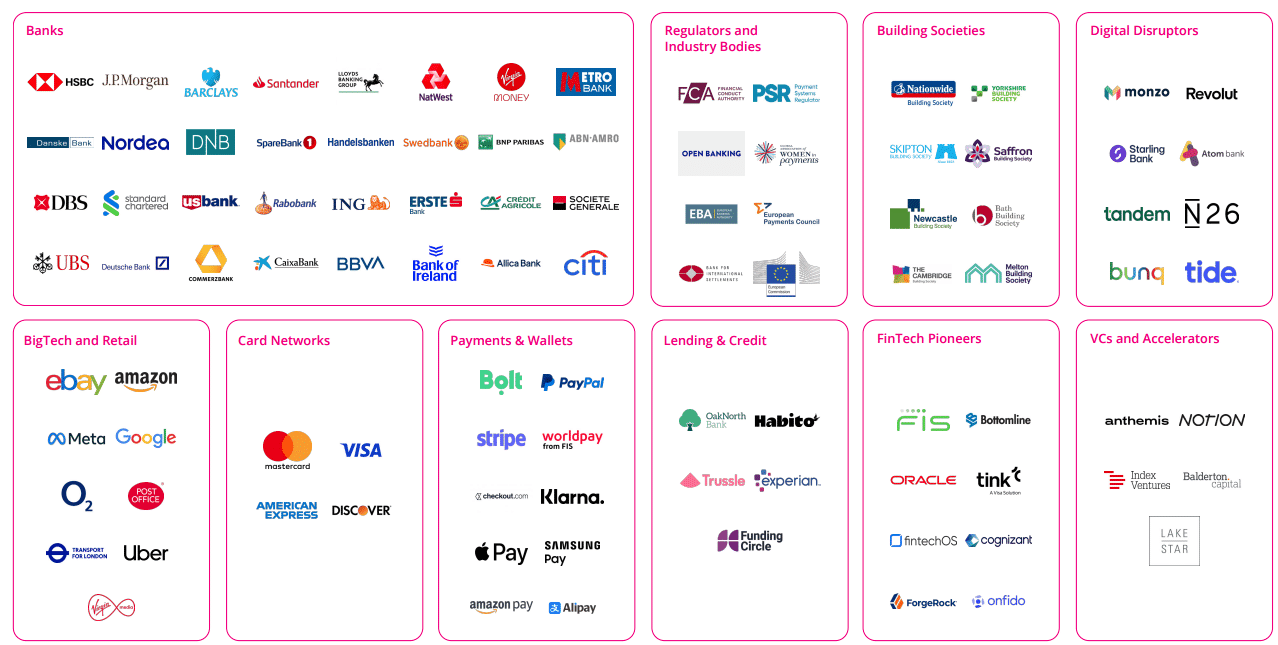

WHO SPONSORS

We’re proud to partner with companies driving innovation in financial services. If engaging with banks or financial institutions is important to your business, sponsor MoneyLIVE Summit and connect with 2,000+ senior decision-makers from leading organisations.

Engage Europe’s banking & payments leaders

The organisations and teams shaping the future of banking and payments meet in London this March.

- Technology and operations teams modernising systems and streamlining processes

- Customer experience and product teams creating seamless, innovative experiences

- Fraud and risk teams strengthening controls and ensuring compliance

- Retail and commercial payments teams delivering next-generation solutions

- Lending and credit teams driving efficiency and expanding portfolios

- Building societies upgrading digital platforms and member services

Where Europe’s banking and payments partnerships begin.

"High-value meetings and conversations."

Gold Sponsor

"An ideal place to connect with our target market - excellent ROI."

GOLD Sponsor

2026'S AGENDA AT A GLANCE

Take a look at the hot topics at 2026's payments and banking event.

9 March 2026 | Day 1

____

Strategies for the future

Intelligent CX

Next-gen payments

Digital ID & authentication

Core banking and data transformation

Meeting the climate challenge

Startup City

Customer journeys and propositions

Cards and wallets

Counter fraud and AML

AI and operations

Lending innovation

Startup City

Resilience and security

Business banking innovation

Workshop | Bank-FinTech partnerships

The Official After Party

10 March 2026 | Day 2

____

Keeping up with the challengers

FIDA and open finance

Commercial payments

Regulatory simplification

Building Societies Forum

Startup City

CBDCS and digital currencies

Building Societies Forum

Agenda at a glance

Take a look at the hot topics at 2026's payments and banking event.

Day 1

____

STAGE 1

Strategies for the future

CEO keynotes

Leaders Forum panel discussion

STAGE 1

Intelligent CX

AI-powered interactions

Modernising financial management

Cognitive banking

STAGE 2

Next gen payments

A2A in action

Instant payments

Modernising architectures

STAGE 3

Digital ID and authentication

EU Digital Identity Wallets

Tackling deepfakes

Bank-verified trust

STAGE 4

Core banking and data transformation

Data modernisation for AI and personalisation

Achieving ROI from transformations

STAGE 5

Meeting the climate challenge

Navigating climate risk

Sustainability for SMEs

Simplifying ESG reporting

Startup City

FinTech scaling strategies

Founders' journeys and question time

M&A funding outlook

STAGE 1

Customer journeys and propositions

Driving customer lifetime value

Life-centric products

Journey design and orchestration

STAGE 2

Cards and wallets

Wallet competition

Card modernisation

AliPay case study

STAGE 3

Counter fraud and AML

Preventing APP scams

AI in AML and counter fraud

STAGE 4

AI and operations

AI and product development

Leveraging AI agents

Achieving operational excellence

STAGE 5

Lending innovation

Open data and credit scoring

AI across the lending lifecycle

Digital home-buying

Startup City

Start-up pitches

STAGE 1

Resilience and security

Cybersecurity in the era of AI

Operational resilience strategies

STAGE 2

Business banking innovation

Relationship management in the age of AI

The digital business banking experience

Cracking the SME lending market

STAGE 3

Workshop | Bank - FinTech partnerships

Building partnerships

Group feedback

The Official After Party

Day 2

____

STAGE 1

Keeping up with the challengers

BigTech innovation

Startup City Awards: vision from the winning start-up

Charting challengers' success

STAGE 1

FIDA and open finance

FIDA: bringing open finance to fruition

API strategy

Preparing for an open finance future

STAGE 2

Commercial payments

Competitive merchant acquiring

Simplifying B2B payments

Cutting the complexity of cash management

STAGE 3

Regulatory simplification

FCA and PSR consolidation

Room 101: simplifying regulatory complexity

STAGE 4

Building Societies forum

Breaking the barriers to homeownership

Delivering higher LTV mortgages

Enhancing ease in the home-buying journey

Startup City

The next unicorns

Where are investors placing bets?

Strategies for successful partnerships

STAGE 1

CBDCs and digital currencies

The Digital Euro

BIS Project Agora

Stablecoins and programmable payments

STAGE 4

Building Societies forum

Serving the next generation

The future of branch networks

Closing the digital gap

End of conference

STARTUP CITY

Uniting the FinTech ecosystem

Where banks and investors meet the next wave of FinTech innovation. Discover emerging talent, connect with game-changing founders, and unlock new commercial possibilities.

Best-in-class networking

The right people are here:

- 60% Financial institutions

- 75% C-level / Director / Head of

- The most innovative FinTechs

- Leading investors

And it’s easy to meet them.

- Conference app open to all

- Full attendee list in app, with messaging capabilities

- App-based matchmaking

- Concierge-led, scheduled meetings

- Job function-focused meetups to spark valuable connections

Smarter Meetings.

Smarter Outcomes.

Connect is our intelligent 1-2-1 meetings programme designed to deliver curated meetings that will deliver real value.

Experience London

MoneyLIVE Summit isn’t just about unbeatable insights and networking — it’s your chance to explore the vibrant city of London. While you’re here, discover the best sights, sounds, and flavours this world-class destination has to offer with our top recommendations.

Why sponsor?

MoneyLIVE Summit will bring together key stakeholders from across the banking and payments landscape.

MoneyLIVE Summit is the place to connect with finance leaders where there will be lots of opportunities to facilitate collaboration, develop robust strategies and keep the wheels of innovation turning.

Our main focus is making sure that the banks are in the room and that we put senior decision-makers in front of your sales team.

Don’t just take our word for it!

Watch the video to hear what our MoneyLIVE series sponsors had to say…