Innovation ignited

Europe's most senior banking and payments event

SAVE THE DATE: 9-10 March 2026 | Business Design Centre, London

MoneyLIVE Priorities and Predictions Infographic

Check out our infographic for key insights into the banking industry's current landscape and future trajectory.

MoneyLIVE Summit sets the agenda for the future of banking and payments.

Hosted in the FinTech capital of the world, MoneyLIVE Summit is the global payments and banking event bringing together industry leaders at the top of their game. This is where ground-breaking partnerships are forged, where innovation is accelerated and where the brightest ideas are born.

Relive the energy

From industry-leading speakers to game-changing discussions, packed networking sessions, and an electric atmosphere - check out highlights from MoneyLIVE Summit 2025!

We'll be back even bigger next year, find out how you can be involved.

Why sponsor?

Sponsor our banking event and make your mark on the banking and payments industry.

Thought leadership

Taking part in a fireside chat, fielding a chair or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

2025 Event Sponsors

Meet our 2025 banking event's partners.

Headline Sponsors

Publicis Sapient

Platinum Sponsors

Amazon Web Services

Collinson Group

Priority Pass

Salesforce

VISA

Gold Sponsors

AUSTRIACARD HOLDINGS

Backbase

CACI

Crossjoin Solutions

DuckDuckGoose AI

Earnix

Equifax

Finance Malta

FullStory

Infosys

Mastercard

Nasdaq Verafin

Personetics

Ping Identity

PriceHubble

Quadient

Red Hat

Similarweb

Sumsub

Temenos

Veriff

Veritran

Silver Sponsors

Adobe

FintechOS

IDVerse

Incode

Refractis

SaaScada

UiPath

Bronze Sponsors

Apromore

Azul

Comarch

Contentstack

Curinos

Deployteq

Eliq

FICO

Finimize

Markaaz

Sage

SurePay

Sutherland

Triple

Startup City Exhibitors

Algoan

ApTap

Baseella

Datavillage

Decisimo

DuckDuckGoose AI

Exactrem

HeyTrade!

Informer

Intelligent Advanced Solutions Inc.

Intrepid Fox

Kodex AI

Marble

Mast Technologies

Mifundo

Moniflo

OneBanx

Prestatech

QaiWare

RelyComply

Sikoia

Tidely

Tweezr

Wenalyze

Wultra

Association Partners

Media Partners

Coin Telegraph

Financial IT

FinTech BoostUP

FinTech Finance News

FinTech Power 50

FinTech Strategy

International Business Magazine

IT Ukraine Association

PCN

Payments Cards & Mobile

PaySpace Magazine

The Fintech Times

The Paypers

“A must-attend event that never disappoints, blending high-quality networking with unique insights from across the industry.”

CEO, Standard Chartered UK

Who attends

Check out who will be attending next year's banking event.

“MoneyLIVE consistently delivers the most exciting banking content and the most engaging speakers.”

Head of Customer and Market Insight,

Virgin Money

2025 CONFERENCE SPEAKERS

Take inspiration from our supercharged speaker line-up at 2025's banking and payments event.

Dr Francesca Carlesi

Ron van Kemenade

Saif Malik

Andrew Ellis

Pierre-Antoine Vacheron

Jorissa Neutelings

Philippe Coue

2025 Agenda at a glance

Take a look at the hot topics at 2025's payments and banking event.

Day 1

____

STAGE 1

Banking strategy and innovation

CEO keynotes

Revolut case study

Leaders Forum panel discussion

STAGE 1

Banking strategy: the key drivers for 2025

Chief Economist forum

Navigating regulatory and policy change

Challenger bank growth strategy

STAGE 2

Payments infrastructure

Cross border payments

ISO 20022

Instant payments

Modernising architectures

STAGE 3

Digital ID and authentication

EU Digital Identity Wallets

The Large-Scale Pilots

Digital ID and fraud

Next-gen authentication

STAGE 4

AI in Action

AI case study

Streamlining workflows

Coding and software development

Optimising operations

STAGE 5

Vulnerability Workshop

Achieving digital accessibility for all

Group discussion

Startup City

Scaling FinTech success in a competitive market

Founders' journeys and question time

STAGE 1

CX and engagement

Protecting vulnerable customers

The AI revolution in CX

Personalisation

Customer strategic priorities

STAGE 2

Open banking payments

The latest on the SPAA

A2A global successes

Commercial propositions

STAGE 3

Counter fraud

Vulnerable customers

AML and perpetual KYC

Preventing APP fraud

Data, analytics and AI

STAGE 4

Legacy modernisation

Creating the agile bank

Cloud migration

Data maturity roadmap

Core modernisation

STAGE 5

AI Workshop

Ethical AI in banking

Group discussion

Startup City

Scale-up strategies

Cross-border expansion

STAGE 1

Lending

Orchestrating the housing ecosystem

AI in credit risk modelling

Optimising collections

Embedded lending strategies

STAGE 2

Payment wallets and cards

Google Pay case study

The latest on the EPI's Wero

Adding value to cards

Alternative payment methods

STAGE 3

Resilience and security

Navigating global regulation

IT security to third party risks

AI and cybersecurity

DORA compliance

Startup City

The venture capitalist view: what to look for in a winning start-up

Overcoming partnership pain points

The Official After Party

Day 2

____

STAGE 1

Open banking commercial models

Customer-centric innovation

Next generation banking

Premium APIs and BaaS commercial models

STAGE 1

Open banking strategies

FIDA: open data in Europe

The UK smart data roadmap

Future of open banking, insurance and pensions

Open data beyond finance

STAGE 2

Optimising payments for merchants

Evolution of eCommerce

One-click payments

SoftPoS and self-checkout

Acquirer propositions

STAGE 3

Building Societies: mortgage innovation

High LTV product innovation

Seamless mortgage journeys

First-time buyer market

Product strategies

STAGE 4

Green Transition

Modelling and mitigating climate risk

ESG compliance: data and reporting

Green financing innovation

StartUp City:

Bank Partnership Workshop

Bank participants will identify a pain point from their own organisation to generate a problem statement for start-ups to address

STAGE 1

Digital currencies and blockchain

The digital euro

The regulated liability network

Smart contracts

Commercial and central bank digital currencies

STAGE 2

Better serving SMEs

The SME banking experience

Streamlining corporate onboarding

Treasury management

SME lending

STAGE 3

Building Societies: digital strategy

Mobile app development

Digital transformation case study

Defining your digital strategy

End of conference

Ai-powered Networking

4000+ QUALIFIED MEETINGS & CONNECTIONS

Benefit from:

- The AI matchmaking tool

- Search, sort and filter the full attendee list

- Instant messaging

- Book and accept meetings

- Build your own personal agenda

Experience London

MoneyLIVE Summit isn’t just about unbeatable insights and networking — it’s your chance to explore the vibrant city of London. While you’re here, discover the best sights, sounds, and flavours this world-class destination has to offer with our top recommendations.

STARTUP CITY

Welcome to Startup City, the innovation epicentre of

MoneyLIVE Summit. This designated hub is designed

to accelerate start-up and scale-up growth, featuring a

dynamic stage, exclusive networking zone, and high-impact

deal booths.

If you’re on the hunt for funding, seeking scaleup

opportunities, or looking to forge distribution partnerships,

you’ve found your ultimate arena.

Why sponsor?

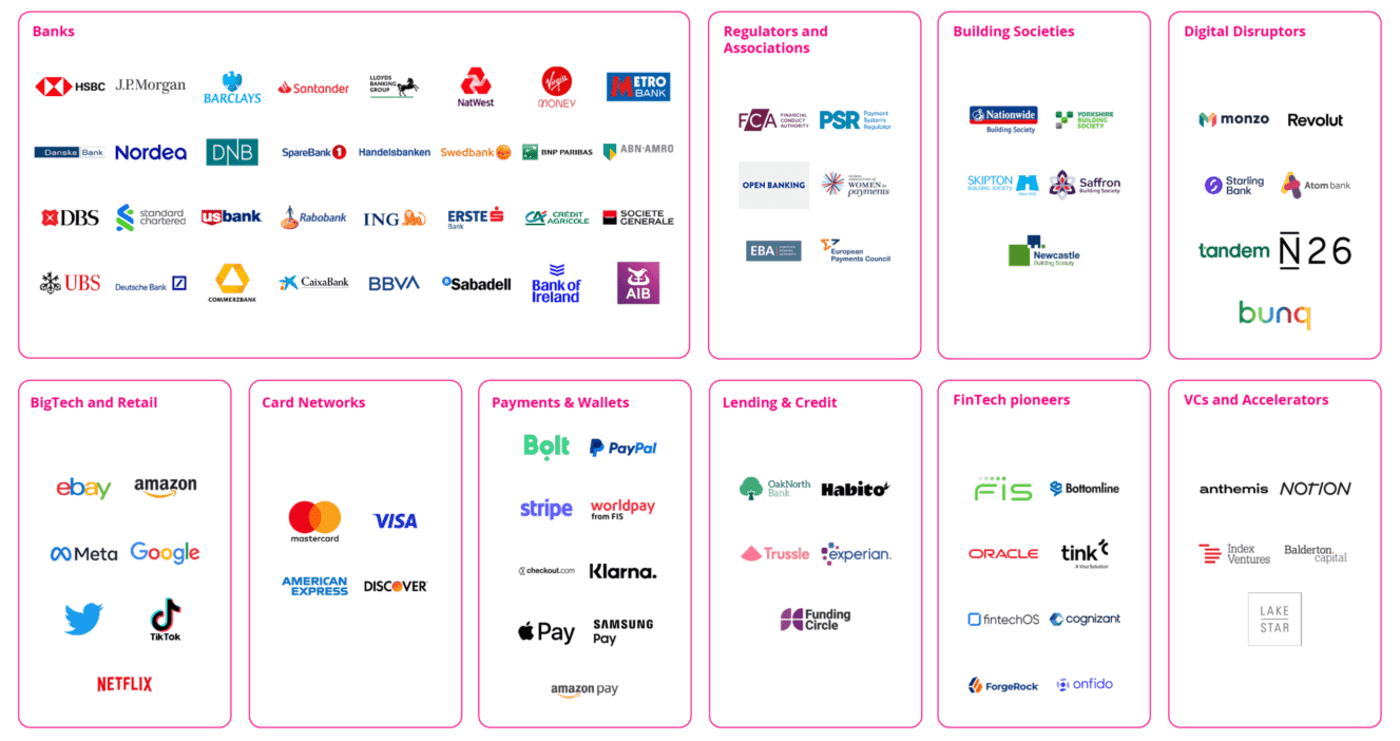

MoneyLIVE Summit will bring together key stakeholders from across the banking and payments landscape.

MoneyLIVE Summit is the place to connect with finance leaders where there will be lots of opportunities to facilitate collaboration, develop robust strategies and keep the wheels of innovation turning.

Our main focus is making sure that the banks are in the room and that we put senior decision-makers in front of your sales team.

Don’t just take our word for it!

Watch the video to hear what our MoneyLIVE series sponsors had to say…

This report takes the insights from our speakers at MoneyLIVE Summit 2024 – a speaker list which included CEOs from Lloyds Banking Group, Revolut, Standard Chartered Bank, Cynergy Bank and more – and combines those insights with the key exclusive takeaways from our C-suite Advisory Board to identify 10 Trends driving the future of the industry.

#MLSUMMIT25

Who sponsors

We are proud to partner with leading lights across the global insurance sector. If you provide solutions to insurers or insurtech ecosystem, this is your best opportunity to connect with 1500+ senior insurance professionals all under one roof.