Innovation ignited.

The leading banking and payments conference in the Nordic & Baltic regions

22-23 October 2024 | Bella Centre, Copenhagen

Watch innovation come to life.

MoneyLIVE Nordic Banking unites the top leaders from across the Nordic and Baltic regions to take innovation to new heights. Be inspired by visionaries, and ensure you're at the centre of transformational developments.

The ideas sparked at MoneyLIVE Nordic Banking will set the bar for future innovations - will you be part of the conversation?

2024 CONFERENCE SPEAKERS

The industry leaders and visionaries joining us in Copenhagen for 2024's banking conference so far

Tomas Hedberg

Jinhong Brejnholt

Jinhong Brejnholt

Jinhong is a highly skilled cloud and platform architect, with a strong passion for DevSecOps practice and cloud-native technologies. She holds an MSc. in Software Development and Technology, and is certified as a Kubernetes application developer, administrator, and security specialist. Currently serving as the Chief Cloud Architect & Global Head of Cloud and Container Platform Engineering at Saxo Bank, Jinhong works to bridge the gap between platform and application teams, with a focus on strengthening infrastructure platform offerings, improving the developer experience and maximizing productivity. She is a strong advocate for sustainable and secure ways of developing and managing applications and integrations. Jinhong’s passion for open source technology and community building has led her to become the organizer for the Kubernetes Community Days and Cloud Native Copenhagen groups, where she helps to spread awareness of open source technologies and grow the cloud-native community in Denmark.

Sverre Hana

Mark Kandborg

Mark Kandborg works as the Group Chief Risk Officer at Nordea. He has previously held several positions within Nordea, here among as Group Chief Financial Officer, Deputy Head of Large Corporates & Institutions and as the Group Treasurer. He has an educational background as an economist from the University of Copenhagen and as Captain in the Danish Army.

Ieva Ileves

Ieva Ileves

| Ieva has 20+ years of experience in public policy working for the government of Latvia, NATO and the EU covering fields of foreign and security policy, digital policy and cybersecurity, strategic communications, human rights and democracy. She led the project team to establish the NATO Strategic Communications Centre of Excellence in Riga and a decade ago was in charge of setting up national cyber security policy. Today Ieva works for the Government of Ukraine as Advisor to the Ministry of Digital Transformation. |

Valters Ābele

Joshua Ting

Höskuldur Hlynsson

Hoskuldur Hlynsson is the Chief Risk Officer of the Central Bank of Iceland, where he has expanded and developed the Bank’s risk management framework. Under his leadership, the risk function encompasses a comprehensive suite of security practices including information security, physical security, and business resilience, alongside traditional operational and financial risk management activities. Prior to his tenure at the Central Bank of Iceland, Hoskuldur held roles in the commercial banking sector as the Chief Security Officer and Chief Data Officer.

Mathias Holm Lyster

Jakob Aarup Petersen

Las Olsen

Kåre Kjelstrøm

Kåre Kjelstrøm has a Master’s degree in Computer Science and +25 years of industry experience working in Denmark, Canada, and the United States as a software engineer and manager. His resume includes work at Uber, Cloud Kitchens, Concordium, and at the consulting company Silverbullet which he co-founded and where he helped digitize the Danish Public Sector for 10 years.

Stephan Erne

Baard Slaattelid

Ville Sointu

Ville Sointu is the Chief Strategist for digital currencies at Nordea Bank. With a career spanning since 2002 in fintech, Ville has held pivotal roles globally, innovating in financial services and connected devices. His expertise is recognized in influential circles, including the European Central Bank’s former Digital Euro Market Advisory Group, the board of Mobey Forum and the advisory board of GSMA’s Inclusive Tech Lab. Ville has also contributed to a number of key industry and policy organizations like the EBF, OECD and EBA and in his free time enjoys co-hosting the ‘Fintech Daydreaming’ podcast, sharing his insights into fintech’s evolving landscape.

Camilla Dahl Hansen

Pekka Suomalainen

Robin Silfverhielm

Vinita Ramtri

Ragnar Toomla

Ragnar Toomla serves as the Chief Product Owner for Digital Channels at SEB, a position he has held since 2021. With over 25 years of experience in digital banking, Ragnar has been instrumental in developing various digital customer service solutions. His work includes contributions to internet and mobile banking, ATM network development, open banking solutions, e-commerce and the creation of electronic invoicing standards and digital identiy services like Smart-ID. He holds an MBA from the University of Tartu and MSc degree in Information Systems Analysis and Design at Tallinn University of Technology.

Camilla Åkerman

Michael Hurup Andersen

Cecilie Moseng

Nicolaj Gudbergsen

Mikko Turunen

Mikko Turunen is the Business CIO of Retail Bank at OP Financial Group, where he bridges the gap between business and IT to drive strategic initiatives and customer value. With a background in OP Group since 2008, he has held various key roles, contributing significantly to the company’s growth and digital transformation. His most recent accomplishment includes leading the successful launch of OP Financial Group’s new core banking system, demonstrating his expertise in driving complex projects and fostering innovation in the financial sector.

Malin Lignell

Malin Lignell has over 20 years of experience working with advisory services for both individual customers and corporates within Handelsbanken. More than ten of these years were spent in leadership roles at several Handelsbanken branches. In 2018 Malin joined the team for Technology & Innovation strategy, where her work now encompasses communications both within the organisation and externally at the strategic and operational levels. The team identifies and evaluates important trends within emerging technologies and explores these in practice. Insights built through dialogue internally and externally, as well as from field experience, are used to drive, inspire and challenge the organisation to become more innovative and focus on the opportunities and challenges that come with the bank’s digitalisation journey. Focus areas are understanding changes in customer behaviour and business models following trends in emerging technologies. Published author in Journal of Digital Banking and Journal of AI, Robotics and Workplace Automation. Both journals by Henry Stewart Publications.

Martin Clausen

Martin Clausen is a distinguished expert in information and cyber security, boasting extensive experience in the field. As the former Global Head of Cyber Security at Saxo Bank, he has showcased his exceptional ability to transform cyber security into a strategic organizational priority. Renowned for his strategic vision and leadership, Martin has significantly contributed to the growth and success of every organization he has been part of. With a robust background in security architecture, Martin merges technical proficiency with a deep understanding of strategic initiatives, industry trends, and cutting-edge technologies. His innovative contributions and thought leadership have firmly established him as a respected authority in the realm of cyber security.

Deeptasree Mitra

Canan Arabacioglu

Tuija Rainisto

Kevin Mountford

Liisa Kanniainen

At Nordea, my mission extends beyond just leading strategic initiatives on connectivity; it’s about forging pathways that redefine our customer experiences and streamline business processes. With a career deeply rooted in transaction banking, my focus has been on nurturing innovation through digital transformation, especially in the realm of open banking and API-driven solutions. My tenure as VP Product Manager of Commercial APIs saw the successful launch of cash management services that not only met but anticipated corporate customer needs, bolstering satisfaction and retention. Championing the cause of digitalisation, I’ve harnessed the power of automation and collaboration to drive both performance and cost-efficiency, aligning with Nordea’s commitment to excellence and customer-centricity.

Trine Lysholt Nørgaard

Philip Haglund

| Gimi – a gamified educational mobile banking app for families, delivered to banks using open banking. |

Eric Ducoulombier

Eric Ducoulombier is, since 1 January 2019, Head of the Retail and Payments Unit in the European Commission (DG FISMA). Prior to that he was Head of the Unit dealing with Inter-Institutional affairs and Planning in DG FISMA. Eric joined the European Commission in 1992, after having worked a few years in the private sector. He holds a Master Degree in Law from the University of Lille (France).

Christian Luckow

| Christian Luckow leads the Core Payments Tribe and Payments Center of Excellence at Danske Bank. Christian has 25 years of experience in the cross-over between business and IT, including as CEO of a working capital company in Australia that specialized in embedded finance solutions for small and medium enterprises. He joined Danske Bank in 2019 where he is leading the transformation of the bank’s core payments systems across all markets, ensuring that they are fast, secure, and compliant with the latest regulations and standards. He is also responsible for engaging with industry and sector partners to foster innovation and collaboration in the payments space. |

Árni Geir Valgeirsson,

Experienced IT leader with focus on business outcomes. Passionate about digital innovation, product development, AI, process automation, security and operational excellence.

David Laramy

Dave has worked in the world of fraud for over 20 years, leading strategy, analytic, operational and change teams.

Juris Rieksts-Riekstiņš

Benny Boye Johansen

Benny Boye Johansen is Head of APIs and Partner Trading at Saxo Bank. He is responsible for all APIs supporting Saxo Banks many partnerships, including our FIX APIs and the OpenAPI which he took from the initial design phase to a full commercial offering. He has been with Saxo Bank since 2004 in various roles, from developer, to department manager, enterprise architect, product manager and IT department head.

Ketil Clorius

A seasoned Fraud and Financial Crime Leader, Ketil has over 18 years’ experience in financial services, including Banking and Big 4 Consultancy. Most recently as Head of Global Fraud Strategy and transformation at SEB, he is responsible for driving the global fraud strategy, governance, data alignment and technology journey. Ketil has been leading several fraud teams everything from Fraud Operations, Data Analytics, Risk Management and Special Investigation. Ketil brings with him great regional experience within the financial services and banking industry across the entire Nordic and Baltic region leading teams. Within Fraud and Financial Crime in particular, Ketil holds deep subject matter expertise across Fraud, AML, Sanctions, Risk Management and Risk Assessments. In addition to his direct management experience, Ketil has a breadth of expertise in technical software solutions, having operated in the software industry as Head of the Centre of Excellence for Fraud and Financial Crime at SAS Institute; implementing Nordic Anti-Fraud and Financial Crime software/solutions across the banks, insurances and in the public sector.

Kadri Vunder Fontana

| Kadri Vunder Fontana is a creative and hands-on strategic thinker who is passionate about sustainability and environmental issues. She has extensive experience in strategy consulting, economic empowerment, and sustainable finance. Kadri currently holds a position as Group head of Sustainability at Luminor Group, where she focuses on driving the bank’s sustainability efforts. She has previously served on the supervisory boards of several organizations, including Cervo Volante AG, delicioustaste AG and BiotaP OÜ. As an author, Kadri has published a book titled “Sales Channels for Targeting Base-of-Pyramid Markets in India.” She is also involved with the ClimAccelerate and ROTARY Zürich Turicum organizations. With her passion for sustainability, Kadri is a knowledgeable and engaging speaker on topics related to climate change, biodiversity, and the transition to a green economy. |

Jakob Palmblad

Annet Steenbergen

Bio Annet Steenbergen After many years working in international border management Annet co-founded/co-initiated the Aruba Happy Flow project in 2013 that created the world’s first seamless passenger facilitation uniting the public and private stakeholder at the airport in one identity management system using a single biometric token. Ever since digital Identity and innovation for the travel eco-system have been at the centre of her work. She is currently a consultant for the travel and tourism industry and works on projects with focus on implementing digital identity and digital travel credentials to create true Seamless Travel while preserving data privacy and data protection. She is a participant in the EU Digital Identity Wallet Consortium. Annet has been actively involved in IATA OneID working groups and task forces and in 2020 she was awarded the Women in Biometrics Award. She is also often asked as a public speaker and moderator.

Martins Berzins

Mārtiņš Bērziņš is experienced digital business development leader, skilled in Mobile, User Experience, Agile, Strategy and Innovative Thinking. Prior Citadele bank created first licensed payment institution in Latvia. Joined Citadele in 2017 and for last 7 years Mārtiņš has led all digital channel development at Citadele focussing on mobile banking and Customer Experience development. Since August 2020 Mārtiņš is Head of Digital Customer Experience and Deputy Business Development.

Espen Molin

Niels Halse

Martina Wallenberg

Kaspars Lukacovs

John Skov

Bjørn Hald Sørensen

| He is a co-creator of the Lunar development platform, enabling Lunar Technology to deliver software continually, quickly, and safely to the cloud and Lunar’s users. |

Jenny Winther

Jenny Winther has more than 25 years’ experience in working with payment infrastructure. She is currently working at Handelsbanken as Head of Payment Schemes. She is a member of the EBA Clearing Board. Jenny also participants in several committees and working groups in the European Payments Council (EPC) and Nordic Payments Council (NPC) as well as the Swedish Bankers’ Association and the Swedish central bank.

Joachim Schwerin

Joachim Schwerin is Principal Economist in the unit responsible for the Digital Transformation of Industry within the Directorate-General Internal Market, Industry, Entrepreneurship and SMEs (DG GROW) of the European Commission. He is responsible for developing the policy approach of DG GROW towards the Token Economy and Distributed-Ledger Technologies as well as their applications for industry and SMEs. His current focus lies on developing positive framework conditions for Web3 and DAOs. In 2020, he contributed to the Digital Finance Strategy, including the MiCA Regulation. Previous responsibilities included the coordination of industrial and competition policy, the design of policy measures to improve SME access to digital finance and conceptual work on strategic aspects of the EU’s competitiveness in the global economy.

Erlend Nitter-Hauge

Aleksi Grym

| Aleksi Grym is Head of the Fintech division at the Bank of Finland. His team is responsible for policy work, analysis and projects covering financial technology, new payment systems and digital currencies. He is a member of the ECB’s digital euro project steering group. |

Einar Eidsson

Einar runs Product at Indó Savings Bank, Iceland’s first challenger bank that’s been growing fast since launching in Jan 2023. Indó offers current and savings accounts and recently launched lending . Prior to Indó, Einar worked with scaling Klarna and digital strategy at Nordea. Einar is super passionate about disrupting the Icelandic banking market and creating a pleasant, fair and transparent banking experience.

Luca Piezzo

I had the chance to work in different industries (Retail, Manufacturing, Banking and Insurance mainly), coping with several challenges of complex IT transformation programs as Executive and Advisory. Since 2016 I’m sharing my experience and vision on Cloud Computing, helping Medium and Large Enterprises on their journey. Strongly convinced that IT should enable business, enhancing the potential of the underlying technology stack that must be a commodity.

Mattias Rohmée

Full focus on corporate strategy development, business analytics and driving our engagement towards EU Commission regarding the EUDI Wallet. Love all things data and how digital identity can unlock the unlimited number of use cases – circa 100 new companies adopt BankID each month.

Jonas Palm

Vanja Söderblom

Fredrik Tallqvist

Elin Westerberg

Simone Poon

Søren Rode Andreasen

Soeren Rode Jain Andreasen has held various leadership roles in the financial sector and is known for his expertise in digital transformation and driving the adoption of new technologies in the banking industry. Andreasen’s professional journey includes working at prominent financial institutions where he has played a pivotal role in leading transformative change and innovation. He spent over a decade at Danske Bank, where he served as the Chief Digital Officer and was responsible for the bank’s digital transformation efforts in the United Kingdom. During his tenure, he played a crucial role in implementing innovative solutions, launching Open Banking, and improving the backend systems of the bank. In 2024, Andreasen made a significant career move and joined the Canadian Imperial Bank of Commerce (CIBC) as the Enterprise Digital and Innovation Officer. This appointment came after CIBC signed a multi-year agreement with Microsoft to migrate many of its operations to the cloud. Andreasen’s role at CIBC involves leading the bank’s digital strategy and driving innovation in the organization. Notably, Andreasen currently heads Digital Customer Engagement at Nordea, the largest bank in the Nordics. In this role, he oversees a dynamic team responsible for Digital Channels, Onboarding of clients, the origination and servicing of everyday banking products, digital money transfers, and the optimization of the retail payments experience. Andreasen’s influential presence extends beyond his professional achievements. He is a sought-after speaker at prestigious conferences and events worldwide, where he shares his invaluable insights on revolutionary topics such as open banking, customer experience, legacy systems, and the paramount importance of enhancing backend operations in the banking sector.

Dan Axelsson

Robert Carlsson

Product manager BankId, responsible for product security. Architect for the BankOd solution in Sweden, held CSO role for BankId for 10+ years. Manager for building internet bank somition for one of sweden main banks

Saira Khan

Saira Khan is the Head of Innovation and Partnerships for First Direct Bank(HSBC), was recognised in Innovate Finance ‘Women in FinTech Powerlist 2023 & 2022’. Having led the creation of innovation teams and centres in the United Kingdom, Asia, and the United States, while building and testing data management and open banking through global hackathons, she has developed a unique vision and reputation for being a catalyst for transformation around the world on leading deliveries with commercial impact. She is known as a key connector and championing moves towards a digital-first culture, enabling greater collaboration and connectivity between startups and corporations with proven results. While her passion and advocacy for change sets her apart from her peers in the finance sector, it is her work mentoring and supporting global talent in Africa, Asia, and the United States that drives Saira as she focuses and champions efforts around diversity, inclusion, education, and sustainability.

Mats Bergius

As newly appointed Chief Commercial Officer and former Country Manager for Norway and Sweden Mats has spearheaded Lunar’s impressive growth, democratising financial services in the Nordics. With a substantial fintech background and as chairman for Swedish Fintech Association, Mats’ expertise is unparalleled. Don’t miss the chance to hear from a leader who’s reshaping how we bank, pay, and invest.

Paulina Kudlacik

| Paulina has 5+ years of experience working in payments and currently holds the role of Scheme Manager for the Nordic Confirmation of Payee scheme at the Nordic Payments Council. In her daily work she owns and manages the rulebook and implementation guidelines of the CoP scheme that is vital to the Nordic banking community in the times of payment infrastructure transformation and changing regulatory landscape in the EU. |

Sune Gabelgård

| 26 years of fighting crime within areas of law enforcement, intelligence services, banking industry, payment services, fintech and mobile wallets. I am not going to the office, I am on a mission to protect corporates, Societies and individuals from falling victim to fraud. |

Peter Lund

Peter has extensive experience from the banking and consulting industry, with a strong footprint in solving complex customers challenges through collaboration between banks and 3rd parties. His passion is to find new ways of doing business in the financial industry, working closely with customers and partners. Peter works with commercial API management in Nordea’s Nordic unit responsible for ensuring PSD compliance and proactively embracing commercial opportunities based on banking APIs.

Sarah Anwar

As Head of Sustainability and Governance at Econans, Sarah supports banks in accelerating the transition of their real estate portfolio through data and tools. Sarah has worked with sustainability in International Organizations and in the Real Estate and Banking sectors and is passionate about the role of data and technology to meet Europe’s ambitious climate goals.

Konstantin Yuminov

Nikolas Schreck

Paul Mullins

Sara Sjölin

Peter Nordgaard

Helene Panzarino

Helene Panzarino

Originally a Commercial Banker, Helene is an Associate Director with the Centre for Digital Banking and Finance in LIBF, an experienced FinTech Programme Director, exited entrepreneur, educator and author. Her career boasts a number of ‘firsts’, including the creation of the FinTech Scale Colab Programme for Rainmaking, the Inaugural Programme of Education and Events for Innovate Finance, the FinTech on the Entrepreneurship Masters’ for UCL. Board and advisory roles include the Spanish digital identity scale up, Biid, the UK safeguarding RegTech, Kalgera, and the SME payments company, TomatoPay. Helene was named on the Computer Weekly 100 Women in Tech Award, the Innovate Finance Women in FinTech Power List, and the Fintech Magazine 100 Women in Fintech list. She was also part of the FCA 2020 Data Sprint on SME Lending, and the recipient of the FT/Google Digital Pioneer Award. Her new book ‘Reinventing Banking & Finance: Frameworks to navigate global fintech innovation’ (Kogan) came out in November 2020, and was named the number one banking book for 2021 by Investopedia.

Martin Gregor Schuricht

Corinna Scatena

Niko Karhapää

Andrew Stevens

With nearly two decades of experience in transforming customer connections at one of the worlds largest financial institutions, Andrew has a proven track record in delivering meaningful change. In his current role as a Customer Experience Principal at Quadient he has been constantly in demand, sharing this knowledge and opinions at events ranging from Helsinki to Sydney, and from San Francisco to Tokyo and countless locations in between.

Michael Heffner

Piotr Jan Pietrzak

Jukka-Pekka Kokkonen

Jukka-Pekka has 16 years of experience in financial services from large corporate sales to product leadership. He has been fighting fraud in Nets and Nexi Group for 5 years and is currently leading the product management teams in fraud and dispute areas. Previously, Jukka-Pekka has been leading the corporate banking channels’ products at OP Financial Group and before that selling global cash management solutions at Danske Bank to large corporate clients. Nexi Group is a leading PayTech in Europe and uses advanced machine learning models to prevent fraud for hundreds of banks in Europe in real time.

Manish Malhotra

Manish is Vice President and Head of Sales at Infosys for Financial Services (FS) EMEA and UK Public Services business. He is also c o head of Infosys UK Proxi mi ty Dev elop ment C enter and a member of EMEA Regional Leadership Team. As Head of Sales, he leads a team of senior sales managers responsible for driving the new business pipeline growth, attracting and on boarding new strategic clients to deliver significant revenue growth and brand recognition across EMEA region. With career spanning over 25 years of work experience across spectrum of client facing leadership ro les in Sales, Business Development, Service Delivery and Programme Management, Manish has helped some of the largest Financial Services organisations to navigate complexity and leverage new technology & thinking to drive business outcomes. Manish is pass ionate about Fintechs on account of the transformation they are driving in the banking industry. At Infosys, Manish has been actively involved in setting up a Global Fin t ech Marketplace to leverage the best of tech to support Financial Services clients in enhancing their propositions across the various markets they serve.

Enrico Gambi

Enrico is a qualified Director of CRIF with over 22 years of experience in the financial sector.

Holger Lehmann

Holger Lehmann is a seasoned business and technology leader with expertise in driving positive business outcomes in digital transformation processes. Holger currently leads the global Business Solution team in Temenos for the Digital, covering Onboarding, Origination and Servicing. Through his career with more than 20 years of experience in the banking software industry he was always focused on providing an outstanding customer experience for financial institutions and their clients. Holger is driven by innovation, effective collaboration, and delivering tailored solutions to meet business needs.

Mauricieo Castanheiro

Nick Platjouw

With over 10 years of work experience in the financial technology sector, I am passionated about the latest trends in the Fintech space. Currently working for Personetics, the global leader in financial-data-driven personalisation and customer engagement for Financial Services. Our mission is to help banks deliver personalised, proactive, and relevant solutions to their customers, enhancing their financial resilience and wellness. In my current role, I am responsible for leading and expanding the sales operations and revenue growth in the Northern Europe region.

Adam Preis

Tim Mussche

Tim Mussche serves as a Area Vice President at nCino NEMEA (Northern EMEA). Tim works with financial institutions to understand their lending processes to help them accelerate their digital transformation projects. Tim has over 15 year experience in financial services. Prior to joining nCino, Tim worked in various senior roles at Bureau van Dijk and Moody’s Analytics in Europe, Singapore and Australia. Tim holds a Masters degree in Business from the ESSCA (Ecole Superieure des Sciences Commerciales d’Angers).

Daniel Holmes

| Part of the Feedzai Product Strategy team, Dan collaborates closely with banks worldwide and supports them to understand the range of fraud prevention and detection capabilities offered by Feedzai. He focuses on aligning the company product strategy with the direction of the future market, ensuring that Feedzai stays ahead of the curve. In addition to working directly with clients, Dan also plays a crucial role in enabling other teams within Feedzai to provide exceptional customer service and results. He is a thought leader within the industry, frequently authoring white-papers and blogs, speaking with press and analysts, and appearing on stage at various events across the globe. Before joining Feedzai, Dan served as the Director of Solutions at LexisNexis Risk Solutions and held various fraud-related positions at Lloyds Banking Group UK. In these roles, he leveraged the latest digital fraud technology to protect the bank’s online and mobile users, demonstrating his extensive expertise in the field. |

William Cooper

Christen Kirchner

| Christen Kirchner, CFE is a Senior Manager with SAS focusing on fraud and compliance solutions across Northern Europe. Throughout her career she has worked with many customers to balance the business requirements with the implications on technology for companies of a variety of sizes, presenting and explaining complex analytical methodologies for varying knowledge levels, and implementing and/or training various components of the product suite. |

Ian White

Ian is a Senior Vice President at MasterCard, with experience across product, sales and commercial, general management, strategy, and M&A/ corporate development.

In his current role, Ian leads MA’s Open Banking business in Europe. In this role, Ian works with a variety of players across financial institutions, PSPs, and merchants in delivering a variety of Open Banking use cases across payments (top ups, bill payments, and ecomm) and data (aggregation, lending, and onboarding). Prior to Open Banking, Ian has held senior roles at Mastercard in product, general management and corporate development across Europe, Middle East, and Asia Pacific

Prior to Mastercard, Ian worked in management consulting with functional experience in due diligence (buy- and sell-side), corporate and competitive strategy, business transformation and restructuring, and business case development across Europe, North America and Asia for Private Equity and Corporate clients.

Magnus Källhager

Magnus is one of the co-founders of Kreditz, a dynamic fintech company operating under PSD2 regulations. With 20 years of experience in the credit industry, he possesses extensive expertise in fraud detection within the credit application processes for both consumer and business. He began his career as an analyst and model developer at Enento (UC) and has collaborated with several leading banks and financial institutions. Magnus has also held the position of Chief Credit Officer at Skandiabanken, validated IFRS9 models at Handelsbanken, and served as a risk manager for various niche banks.

Mikkel Winston

| Mikkel Winston is a highly accomplished executive with deep expertise in leadership, FinTech, and strategic business consulting. He currently serves as Country Manager at Kreditz, a leader in Open Banking-driven credit decisioning services. Additionally, Mikkel holds the position of Chairman of the Board for the Danish Association of Credit Management, where he has played a pivotal role since 2020 in shaping the industry. With a proven track record of scaling companies across the Nordics, his career spans CEO roles in several consumer credit firms, where he has consistently driven growth and strategic innovation. |

Tanja Wesén

Lukáš Rut

Jos Veendrick

Jos Veendrick, Vice President, Head of Continental Europe, TSYS Jos Veendrick has more than 30 years’ experience in financial services of which 25 years are in the cards and payments business working with issuing and acquiring banks along with payment processors. In 2009, Jos took responsibility for the relationship management of all TSYS Continental European processing clients as Director of Relationship Management. Today, in his role as Vice President, Jos is responsible for both relationship management and new business by building out the TSYS client footprint with the TSYS payment stack and value added services in Continental Europe.

Erwin Voloder

Erwin has over 8 years of international experience in the blockchain sector across product, technology and regulation. He is a former economist with both the European Commission and European Central Bank. Currently he is head of policy at the European Blockchain Association where he leads advocacy and research initiatives between the web3 community and public institutions. He frequently participates in expert working groups around digital asset policy while advising EU Member State governments and private companies. He has published research on decentralised finance and also cross-border payments including the use of stablecoins/CBDCs for international trade and development.

Rasmus Eskestad

2024 HOT TOPICS

Next-gen AI

Explore the next-gen AI revolution with pioneers from Íslandsbanki and Danske Bank. Distinguish fad from fiction and unleash the power of generative AI in banking.

The future of payments

Hear from the European Commission, Handelsbanken, Danske Bank, EBA Clearing and Kompasbank for the latest developments in instant payments, open banking payments and digital wallets.

Open innovation

Join Nordea, Saxo Bank, Commerzbank and SEB to elevate your open finance journey. Get to grips with FIDA, ignite cross-sector partnerships and supercharge commercial APIs.

Lending strategies

Dive into the forefront of lending innovation with Danske Bank, Kompasbank and indó Iceland as they unpack AI-driven credit decisioning, economic landscapes and more.

CX in a digital arena

Navigate the digital age with confidence. Join SBAB, Nordea, Lunar, Swedbank and Citadele Banka to deliver real value to customers, lock in loyalty and cultivate lasting relationships with customers.

The platform economy and APIs

Get ready to seize the commercial opportunities of the platform economy. Dive into the next chapter of embedded finance and unlock new API business models.

Digital currencies and CBDCs

Connect with pioneers from Bank of International Settlement, Nordea, and the European Blockchain Association to chart the digital currencies roadmap and prepare your organisation for the future of money.

The green transition

Embark on the road to Net Zero with trailblazers from DNB, Sparebank 1 SR-Bank, Luminor and Jyske Bank. Master ESG governance and optimise operations for a greener future.

YOUR EXPERIENCE

The Official After Party - sponsored by Mastercard

THIS is where the magic happens! Expect amazing views under open skies as we head to the 19th century wooden Lake Pavilion at Restaurant Babylon, an iconic landmark in Copenhagen.

Here, you'll enjoy signature cocktails and delicious canapes as you continue making those all-important connections. This year’s after party will be our biggest one to date!

WHO ATTENDS

Just some of the companies who have attended MoneyLIVE Nordic Banking

“MoneyLIVE is the arena where you can meet peers across banking, fintech and technology. Gathering everyone in one place creates room for creative thinking across companies and borders.”

Senior Strategic Partnership Manager - DNB

2024 SPONSORS SO FAR

Platinum Sponsors

Mastercard

Gold Sponsors

Appian

CRIF

Infosys

Nasdaq

nCino

Nexi / Nets

Ping Identity

Quadient

Feedzai

Personetics

SAS

Temenos

Silver Sponsors

Bronze Sponsors

DataExpert

LexisNexis Risk Solutions

Schuberg Philis

Backbase

Newgen

Zoot

Worldline Financial Services

Media Partners

Cointelegraph

Mobey Forum

PaySpace Magazine

The Paypers

Financial IT

Cards and Payments Jobs

Banking CIO Outlook

Coin Telegraph

The Fintech Times

Innovation Magazine

FinTech Power 50

Crypto.news

SPONSORSHIP AND EXHIBITION OPPORTUNITIES

Explore sponsorship opportunities for the Nordic's leading banking conference

Thought leadership

Taking part in a fireside chat, fielding a chair or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

“MoneyLIVE is the place to meet the entire industry and discuss the topics that matter most right now”

Business Development Manager - BankID and BankAxept

2024 agenda at a glance

Just a taste of what's in store at this year's banking conference

Day 1

____

The future of Nordic banking

Unlock insights from Swedbank, Citadele Banka, Standard Chartered, Nordea and Handelsbanken

STAGE 1

Open innovation

PSD3 and the open data economy | Open finance | Commercial API development

STAGE 2

Building the payment rails of tomorrow

Bringing instant payments to fruition in Europe | Real-time fraud prevention | Preparing for instant cross-border payments

STAGE 3

Digital identity

The EU ID wallet | The future of authentication and verification | Digital IDs

STAGE 4

AI Lab

Dawn of the EU AI Act | Generative AI quick-fire case studies | Customer chatbots | Internal operations | Fraud detection | Operationalising AI

STAGE 1

Lending

The Nordic economic outlook | Taking credit decisioning to the next stage | Adapting lending strategies to a new landscape

STAGE 2

Open banking payments

SPAA | The global A2A landscape

Wallets

The future of digital wallets

STAGE 3

Fraud and financial crime

Tackling financial crime in the digital ecosystem | AI and fraud: a double-edged sword | Fraud prevention

STAGE 4

Think tank: FinTech and Bank partnerships

Delegates will have a chance to pool their ideas and knowledge together to explore how bank-FinTech partnerships can be primed for success. Share your knowledge and learn from others’ best practice in this lively, interactive session.

Operational strategies

Talent strategy | A generative AI-powered workforce | Charting the route to operational optimisation

After Party!

Day 2

____

CX in the digital arena

Unlock insights from Citadele Banka, Saxo Bank, SBAB, Nordea and Quadient

STAGE 1

Platforms and ecosystems

Winning in a world of ecosystems | Embedded finance | Banking in a platform economy

STAGE 2

Digital currencies

Preparing for the digital euro | MiCA: how will the new regulation impact the European crypto market? | Realising the commercial opportunity of digital currencies

STAGE 3

Resilience and security

Enhancing operational resilience through DORA | Navigating cyber risk | Taking resilience to new heights

STAGE 1

The Net Zero transition

Championing sustainability in banking | Effective ESG governance and reporting | The road to Net Zero

STAGE 2

Legacy modernisation

Cloud composability and beyond | Determining your cloud strategy | Defining your cloud migration strategy

End of conference

AI-POWERED NETWORKING

150+ MEETINGS | 500+ CONNECTIONS | 1000+ MESSAGES

Benefit from:

- The AI matchmaking tool

- Search, sort and filter the full attendee list

- Instant messaging

- Book and accept meetings

- Build your own personal agenda

Conference tickets

The more you buy, the more you save

Group of 5+

Financial services*

Save 20% on tickets when you book a group of 5+

Group of 3+

Financial services*

Save 15% on tickets when you book a group of 3+

Group of 3+

Standard*

Save 15% on tickets when you book a group of 3+

Financial Institutions*

£1,749.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

Standard

£2,299.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

You are purchasing tickets at the Rate

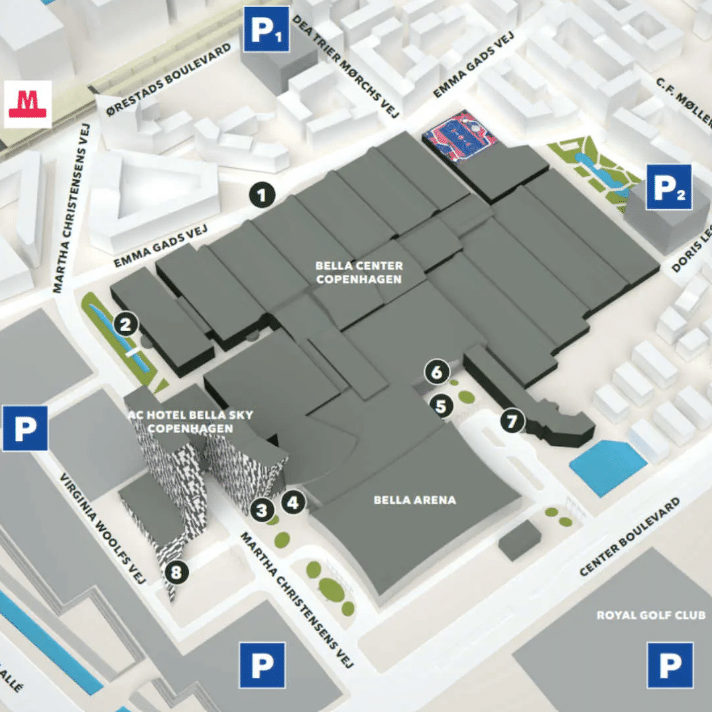

THE VENUE

Access the conference venue using entrance 3

Your ticket to MoneyLIVE Nordic Banking unlocks a discounted rate to AC Bella Sky Hotel

Book your room between Saturday 19 and Thursday 24 October through the link below to secure our discounted rate:

1495DKK per night (incl. 25% VAT and breakfast buffet)

Rate expires on 5 October 2024

2023 HIGHLIGHTS

Thank you to all of those that joined us for our banking conference in Copenhagen last October, including our super-star speakers and sponsors!

More from MoneyLIVE

Digital euro deep dive with Banque de France

Alex Stervinou, Director - Cash and Retail Payments Policy and Oversight Directorate, Banque de France

Now available to stream

What is the real value of the digital euro? According to Alex Stervinou, this is the question we should be asking if we are to make real progress when it comes to a Europe-wide digital currency. Watch for insights on ideal CBDC platform requirements, the central bank’s POV on financial stability and more.

Forecasting the future of

payments innovation

In conversation with Aleksi Grym, Head of FinTech, Bank of Finland

An exclusive interview

As a member of the Eurosystem’s digital euro project steering group, there’s no one better placed to give us the payments lowdown. Hear Aleksi’s thoughts on the future of payments innovation.