Innovation ignited.

Europe's most senior banking and payments event.

10-11 March 2025 | Business Design Centre, London

2024's event sold out, book early to confirm your place for 2025!

MoneyLIVE Summit sets the agenda for the future of banking and payments.

Hosted in the FinTech capital of the world, MoneyLIVE Summit is the global payments and banking event bringing together industry leaders at the top of their game. This is where ground-breaking partnerships are forged, where innovation is accelerated and where the brightest ideas are born.

“An unmissable event for those serious about banking and payments transformation.”

Global Head of Strategy & Innovation, ING

Sponsorship options

Explore options for sponsoring our banking event.

Thought leadership

Taking part in a fireside chat, fielding a chair or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

Why sponsor?

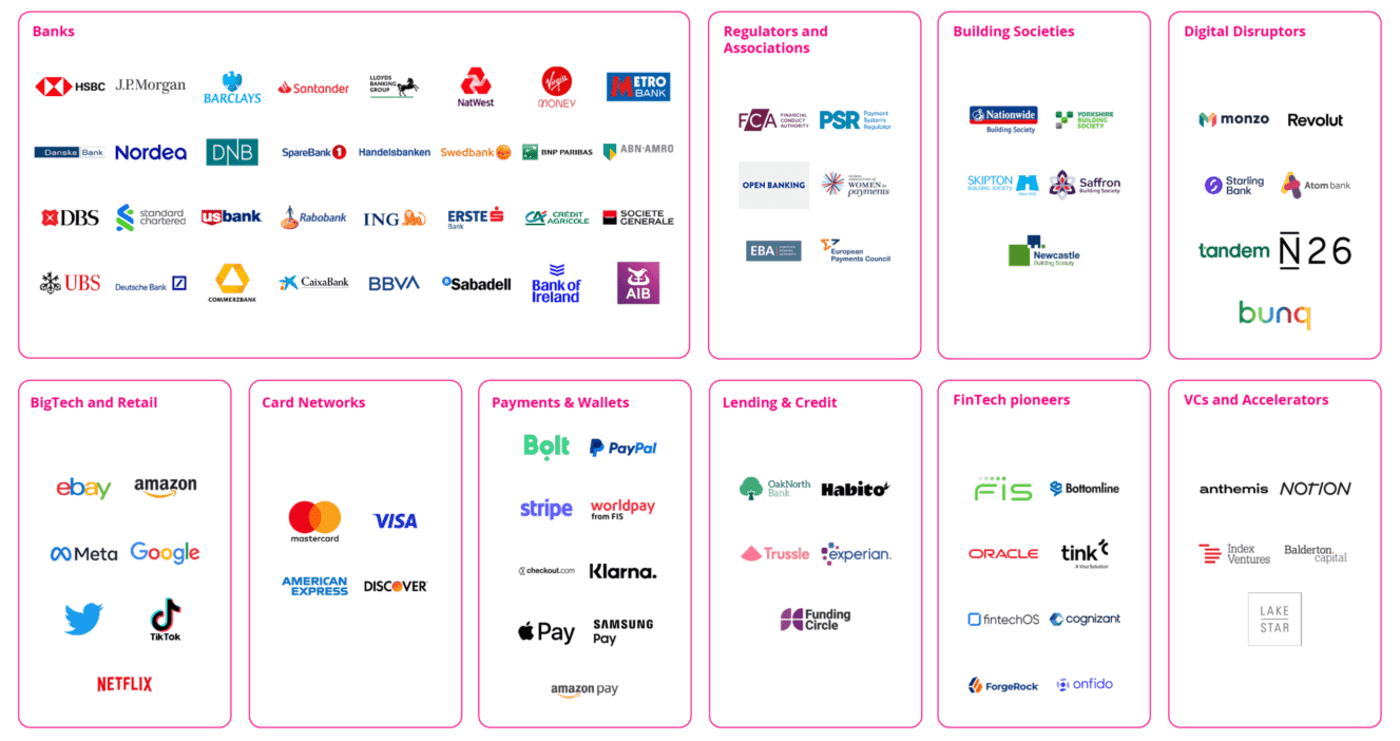

MoneyLIVE Summit will bring together key stakeholders from across the banking and payments landscape.

As a solutions provider, MoneyLIVE Summit is the place to connect with finance leaders where there will be lots of opportunities to facilitate collaboration, develop robust strategies and keep the wheels of innovation turning.

Our main focus is making sure that the banks are in the room and that we put senior decision-makers in front of your sales team.

Don’t just take our word for it!

Here’s what our MoneyLIVE series sponsors had to say…

2024 Event Sponsors

Headline Sponsor

Platinum Sponsors

FintechOS

Gold Sponsors

Thales

Silver Sponsors

Bronze Sposnors

nsKnox

Webex by Cisco

Education Partner

Media Partners

Cointelegraph

Financial IT

FinTech Power 50

Mobey Forum

The Fintech Times

The Paypers

Our MoneyLIVE Summit Advisory Board

Our advisory board helped to steer 2024’s agenda to reflect the most pressing issues in the market.

Paul Horlock

Paul Horlock, Chief Payments Officer at Santander UK, oversees a unified UK Payments team collaborating with the European region under One Santander.

Des Moore

With nearly 40 years in retail and commercial banking, Des has led The Cumberland through significant transformation for 3.5 years, focusing on sustainability for Customers, Communities, and Colleagues.

Christopher Hunter

Chris Hunter, N26’s Global Head of Executive & Business Recruiting since 2020, oversees senior leadership team expansion in various functions like marketing, people, operations, legal, and banking.

Kevin Mountford

With 30 years of experience in senior management and executive roles, Kevin has worked with prominent UK brands like Bank of Scotland, HBoS, and Birmingham Midshires.

Conrad Ford

Conrad Ford, Chief Product Officer at Allica Bank, heads one of the UK’s Top 20 fintech firms according to The Times.

2024 Event Speakers

Take a look at who spoke at this year's banking event.

Dr Francesca Carlesi

Saif Malik

Nick Fahy

Angela Byrne

Mark Mullen

Sujata Bhatia

David Geale

Des Moore

David Morris

Neil Robinson

Klaus Baader

Michael Anyfantakis

Paul Szumilewicz

Marisa Drew

Dan Kellett

Jakub Malach

Vladislavs Mironovs

Kevin Mountford

Ravneet Shah

Taylan Turan

Mathew McDermott

Ruth Foxe Blader

Susanne Parry

Paul Clark

Ange Johnson De Wet

Sebastian Takle

Kate Fitzgerald

Alina Agurida

Dante Jackson

Conrad Ford

Karen Kerrigan

Carole Charter

Connie Blacklock

Ronan Carter

Dan Rosenfield

Callum Ludgate

Dag-Inge Flatraaker

Emma Fletcher

Joel Perlman

David Murphy

Clive Kornitzer

Matthew Baillie

Vinita Ramtri

Stephen Bowe

Aaron Elliott-Gross

Dr Marion Laboure PhD

Sergio Gorjón

Colin Field

Henk Van Hulle

Matt Bullivant

Alex Stervinou

Benjamin Dellal

Deeptasree Mitra

Dastan Shukanayev

Hetal Popat

Matthijs van Voorst

Gurminder Bhagrath

Julian Phillips

Simone Poon

Emanuela Saccarola

Terje Aleksander Fjeldvær

Dirk Haubrich

Nick Stace

Einar Eidsson

Marco Eijsackers

George Miltiadous

Taner Akcok

Anna Roughley

Willem Knaap

Philip Bonhard

Howard Rawstron

Diederik Bruggink

Stephen Wright

Joris Hensen

John Skov

Jennifer Lloyd

Kevin Dearing

Dave Pickering

Vangelis Tsianaxis

Suresh Sankaran

Luca Piezzo

Aruna Bhalla

Monica Carlesso

James Blagg

Jonas Brännvall

Christian Kramer

Anurag Maheshwari

Saira Khan

Giles Taylor

Claire Simpson

Carolyne Gregory

Nadesh Sithambaram

Elinor Hull

Stacey Wilkinson

Sanjeev Bhatti

Lee McNabb

Luke Vilain

Simon Eacott

Richard Dana

Jaco Koenig

Jamie Renehan

Rachita Arora

Nicholas Carlton

Dan Mines

Paul Mullins

Andrew Cunningham

David Bennett

Pauline Schreuder

Laura Myers

Michael Hammond

Ben Schuldenfrei

Jordan Sinclair

Louis Rosher

Helene Panzarino

Eliot Heilpern

Siddharth Venkataramakrishnan

Philip Haglund

Corinna Scatena

Isa Goksu

Harry Newman

Jack Spiers

Irena Simakova

Dorel Blitz

Frederik Mennes

Adam Preis

Paul Higgins

Julien Defosse

Mick Fennell

Muskan Varshney

Andrei Gaman

Ashish Bhatnagar

Jonathan Causier

Freddy Arthur

Karl Graham

Nick Emanuel

Marco Venuti

James Hunt

Puneet Chhahira

Steve Round

Simon Cox

Aman Virk

David Capezza

Rob Woods

Mark Cunningham

Parker Crockford

Nigel Adams

Matt Churchill

Ina Iftime-Steinwandt

Michael Shand

Tom Pilling

Peter Bayley

Jake Levy

Conference tickets

The more you buy, the more you save

Group of 5+

Financial services*

Save 20% on tickets when you book a group of 5+

Group of 3+

Financial services*

Save 15% on tickets when you book a group of 3+

Group of 3+

Standard*

Save 15% on tickets when you book a group of 3+

Book before 6 December 2024 for an Early Bird discount

Financial Services*

£1,199.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

Standard

£2,149.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

You are purchasing tickets at the Rate

Start-up Rate

Do you work for a start-up at seed-stage, that has < £5 million in annual revenue, and has been in business < 5 years? If so, you can apply for the start-up rate to attend MoneyLIVE Summit and a member of our team will get in touch.

Press Passes

Are you an accredited member of the press? Do you work for a publication seeking new partnership opportunities? Apply today to see if you are eligible for a complimentary press pass to attend MoneyLIVE Summit.

“MoneyLIVE consistently delivers the most exciting banking content and the most engaging speakers.”

Head of Customer and Market Insight,

Virgin Money

Watch on-demand with MoneyLIVE TV

Filmed at MoneyLIVE Summit 2023

Future-proofing banking

Thriving in the face of economic, digital and environmental change

Now available to stream

This webinar explores the macro trends that will shape the future of banking, and how organisations can successfully adopt a “composable banking” approach to stay ahead of the curve.

Accelerating lending innovation in the face of economic and digital change

Now available to stream

From low-code/no-code to AI-powered credit risk assessment, this webinar explores how to deliver faster ‘time-to-money’ lending, responding nimbly to both competitor threats and customers’ changing needs.

#MLSUMMIT25

Plan a campaign

By submitting this form you are agreeing to our Privacy & Cookies Policy.