Europe's most influential

payments event

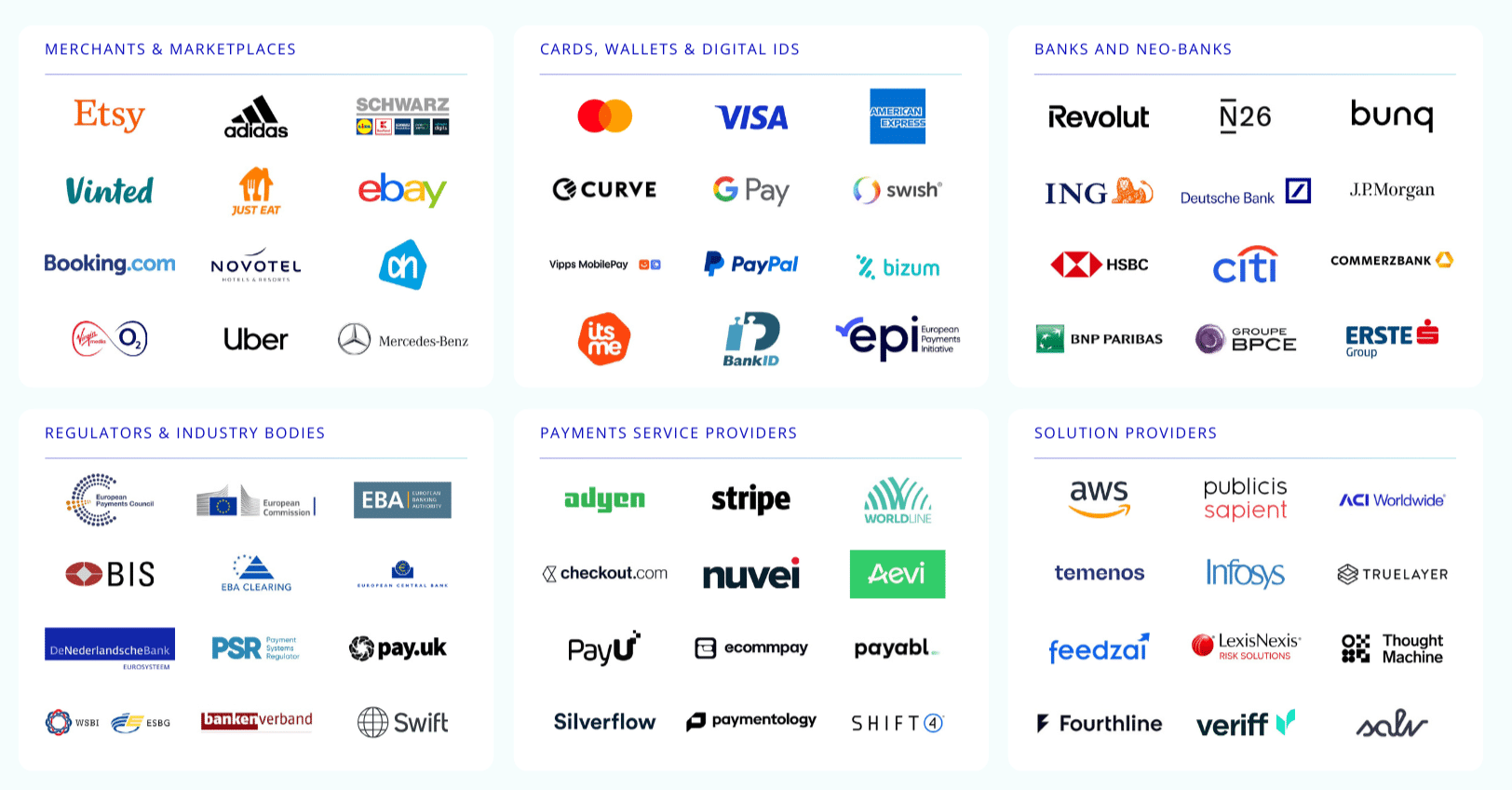

Uniting Europe's top leaders across the merchant and payments ecosystem

19-20 November 2025 | SugarFactory, Amsterdam

Making a revolution in payments a reality.

At MoneyLIVE Payments Europe, leaders and innovators unite to chart the future of payments transformation. We’re ready to double down and bring clarity to the future of payments – will you be part of the conversation?

2025 SPEAKERS

Take a look at some of the big names we've already confirmed for this year's payments event.

Saif Malik

Saif Malik is the UK Chief Executive Officer and Head of Client Coverage. In this role, he leads the UK and the management and development of the corporate and financial institution client relationships in the UK. Saif joined Standard Chartered in 2006 and has held various leadership roles across the client businesses including, Co-Head of Wholesale Banking with Standard Chartered Nigeria, Head of Corporate & Institutional Clients with Standard Chartered Malaysia, Regional Co-Head of Global Banking for Africa & Middle East, and Global Head our multinational corporate business (Global Subsidiaries). Before he joined Standard Chartered, Saif held roles with Barclays Bank Tanzania, Barclays Bank Zambia, as well as a brief stint with the Central Bank of Zambia. Saif is a passionate advocate for a sustainable, diverse and an inclusive global future. He possesses a wealth of Banking and Finance experience in the areas of sales & business development, marketing and corporate credit. Saif holds a Bachelor of Arts in Economics and a Master of Arts in International Business, both from the University of Kentucky, USA.

Divya Bhardwaj

Nico Kersten

Ludovic Francesconi

Arena Fernández de Bobadilla Amoros

Laurens Schretlen

Jeroen Kok

Dmitry Olerinskiy

Our Merchant Attendees

CXOs, Directors, Heads, and more from some of the biggest global brands including:

- GM Payment Acceptance & Experience EU/UK, Amazon

- Chief Financial & Operating Officer, Uber

- CEO & Managing Director, Mercedes Pay

- Director Payments Europe, Trip.com Group

- Head of Global Technology and Payments, TUI Travel

- Group Payment Director, Douglas Group

- Product Director Payments, Albert Heijn

- Digital Strategy Director, Decathlon

- Head of Payment Product, Adidas

- EMEA Payments Lead, Google Pay

- Head of Product Payments, IKEA

- Global Payment Manager, Heineken

- Group Partnerships Lead, JD Sports

- Payments Strategy, Lemonade

- Head of Payments, OVO Energy

- Payments & Consumer Credit Product Lead, Samsung

- Senior Manager Corporate Payments, Schwarz IT KG

- Payment Partnership Lead, Spotify

- Fraud Strategy, Policy and Product Owner, Virgin Media O2

2025 agenda at a glance

Take a look at the hot topics for 2025's payments event.

Day 1

____

A new era for European payments

EPI Wero: one wallet for Europe | Ecosystem partnerships | Modernising marketplace payments

STAGE 1

Point of Sale innovation

Next evolution of contactless

The power of SoftPoS an mPoS

Data-driven loyalty and rewards

STAGE 2

Instant payments: from mandate to monetisation

Instant payments and payout use cases

Combatting instant payments fraud

Readying real-time corporate treasury

STAGE 3

AI, AML and counter fraud

Dealing with deepfakes

The evolution of AI-powered fraud

Leveraging AI and automation in counter fraud and AML

STAGE 1

Enhancing ecommerce strategies

Transforming online checkout

Enabling seamless subscriptions

Combatting ecommerce fraud and chargeback risk

STAGE 2

Comercialising open banking

The future of A2A payments in Europe

Cracking the commercial model

Open payment use cases for merchants

STAGE 3

Combatting scams and

APP fraud

Global approaches to APP fraud

Meta case study

Collaborating across the ecosystem

STAGE 1

Digital identity and authentication

EU digital identity wallets

Biometric innovation

Charting the future of digital identity and payment authentication

STAGE 2

Payments modernisation

Safeguarding payments resiliency

ISO 20022 post-migration

Modernising payments architecture

After Party

Day 2

____

Optimising payments for merchants

Modernising merchant services | Payment orchestration | Meeting merchant needs: from cost to control

STAGE 1

Digital wallets and cards

GooglePay and BizumPay case studies

Wallet wars: the competitive outlook

Card modernisation strategies

STAGE 2

Cross-border payments

Demystifying key schemes and initiatives

Blockchain for cross-border

The future of cross-border payments

STAGE 3

Corporate treasury & B2B payments

Simplifying marketplace payments

B2B innovation: virtual cards, BNPL, and Request to Pay

Enhancing corporate treasury

CBDCs and blockchain

The Digital Euro | Programmable payments | The impact of retail CBDCs

End of conference

“Great speakers covering hot topics about the future of payments make this a 'must attend' event for those in the payments industry!”

Head of Pix Management and Operations, Banco Central do Brasil

“An unmissable event for those serious about banking and payments transformation.”

Global Head of Strategy & Innovation, ING

Networking

Unlock unparalleled networking at MoneyLIVE Payments Europe with AI-powered connections and personalised 1-to-1 meetings through our Networking app.

The MarketforceLive Networking App

Use our dedicated networking app to schedule meetings, connect with other attendees, and manage your MoneyLIVE Payments Europe experience. Our analytics-based matchmaking and networking app ensure you meet the people who matter most to your business.

1-to-1 meetings

Pre-arrange private meetings with attendees who match your business needs. Our analytics-based matchmaking ensures you meet the right people, maximizing the value of your time at the Summit.

The Official After Party

Cap off your MoneyLIVE Payments Europe experience with an unforgettable after party. It's the perfect opportunity to unwind and catch up with your peers and prospects. Good food, good drinks and good vibes are guaranteed!

THE VENUE

We’re returning to one of the hottest venues in Amsterdam, the SugarFactory to provide a conference experience to remember.

We’re curating a space like no other for this year’s show. Immerse yourself in a high-energy environment that will leave you feeling motivated and inspired.

Why sponsor?

MoneyLIVE Payments Europe will bring together key stakeholders from across the payments landscape.

MoneyLIVE Payments Europe is the place for solution providers to connect with key payments innovators where there will be lots of opportunities to facilitate collaboration, develop robust strategies and keep the wheels of innovation turning.

Our main focus is making sure that the key payment players, merchants, and retail banks are in the room and that we put senior decision-makers in front of your sales team.

There are a range of ways to be involved with this payments conference, from thought leadership sessions, to hosting private events.

Don’t just take our word for it! Here’s what our MoneyLIVE series sponsors had to say…

Sponsorship options

Explore options for sponsoring our payments event.

Thought leadership

Taking part in a fireside chat, fielding a speaker or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

Our Sponsors

Past Sponsors

Azul

BLIK

Curve

Fourthline

Infosys

LexisNexis Risk Solutions

Mastercard

Publicis Sapient

Temenos

Triple

Veriff

Veritran

Worldline

WHAT YOU CAN EXPECT

Europe's payments ecosystem in one place

MoneyLIVE Payments Europe unites the whole payments ecosystem, bringing together banks, merchants, marketplaces, gateways, orchestrators, card networks and wallets – all under one roof.

Forge new partnerships

At MoneyLIVE, networking takes centre stage. From VIP meetings and a dedicated networking zone to an after party in one of Amsterdam’s hottest venues. Just imagine the new partnerships you could forge.

Experience best-in-class content

With carefully curated discussions from payment infrastructure modernisation and open banking innovation to developing seamless payment experiences, you can choose the content that’s right for you.

Superstar speaker line-up

With C-Suite speakers and board members from Revolut, Uber, eBay and ABN AMRO and more, this is your opportunity to learn from innovation trailblazers, and measure up against the competition.

2025 Key themes

Ecommerce and PoS Innovation

• SoftPoS and mPoS

• Enhancing loyalty and rewards

• Seamless subscription

• Reducing fraud and chargeback risk

Instant and open banking payments

• Business use cases for corporates

• Combatting instant payment fraud

• Cracking the A2A commercial model

• Customer adoption and payment certainty

Counter fraud

• Dealing with deepfakes and AI-powered fraud

• Leveraging AI in counter fraud and AML

• APP fraud: a whole value-chain approach

Digital identity and authentication

• Latest on EU digital identity wallets

• Biometric innovation

• The future of payment authentication

Digital wallets and cards

• GooglePay and BizumPay case studies

• The outlook for wallet competition

• Card strategy: keeping cards top of wallet

Corporate treasury and B2B payments

• Simplifying marketplace payments

• B2B innovation: virtual cards, BNPL, Request to Pay

• Modernising corporate treasury

Cross-border payments

• EuroPA: connecting instant payment schemes

• Key schemes and initiatives: OCT Inst, IXB, Project Nexus

• Blockchain: simplifying cross-border with DLT

CBDCs and blockchain

• Latest updates on the digital euro

• Programmable payment case study

• The impact of CBDCs on the value-chain

Ai-powered Networking

150+ MEETINGS | 500+ CONNECTIONS | 1000+ MESSAGES

Benefit from:

- The AI matchmaking tool

- Search, sort and filter the full attendee list

- Instant messaging

- Book and accept meetings

- Build your own personal agenda

Conference tickets

The more you buy, the more you save

Group of 5+

Financial services*

Save 20% on tickets when you book a group of 5+

Group of 3+

Financial services*

Save 15% on tickets when you book a group of 3+

Group of 3+

Standard*

Save 15% on tickets when you book a group of 3+

Final tickets selling out fast!

Financial Services*

£1,649.00 +VAT

✓ 2 days of content

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

Merchants*

£1,649.00 +VAT

✓ 2 days of content

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

Standard*

£2,299.00 +VAT

✓ 2 days of content

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

You are purchasing tickets at the Rate

Keen to report on the content at #MLPAYMENTS25?

2024 HIGHLIGHTS

Thank you to all of those that joined us for our payments event in Amsterdam last November, including our super-star speakers and sponsors!

More from MoneyLIVE

Interview

Cross-border payments: the next frontier

Gain insights from Simon Eacott, Head of Payments at NatWest, who gives us his outlook on the cross-border space right now and the actions the industry needs to take in order to make cross-border payments safe, speedy and simple, all at a low cost.

Article

The Future of Open Banking Payments

This article explores how open-banking-driven payment flows are evolving, what opportunities and risks lie ahead for banks, fintechs and merchants, and how the ecosystem must collaborate to turn this potential into reality.

Interview

Real-time payments: a system fit for the future

The Bank of England is renewing it’s RTGS programme – John Jackson digs into the what, why and when of real-time payments and how the RTGS programme is impacting banks.

Article

Kristy Duncan, Founder and CEO, Global Association of Women in Payments on Financial inclusion: why it’s important, and how FinTech can help.

Given that, in 2017, only 65% of women globally had a financial account, compared with 72% of men, one can see how women may be disadvantaged from the start. In this article Kristy Duncan, Founder and Chief Executive Officer, Global Association of Women in Payments, addresses the tangible benefits financial inclusion can bring to women and outlines how FinTech can help increase access to financial services.