ARTICLE

What is Money?

The thoughts of Lee McNabb, Head of Strategy & Research, Payments at NatWest

Money can be so much more than it is today, what would work better for everyone?

We spend a lot of time making and receiving payments, moving money, but rarely do we stop to think about what is actually moving between the various parties involved in the process. Especially true if you don’t work in the industry, I mean, who cares, right? As long as it gets there.

Money in the UK works in one unit of account, the pound sterling, but it takes different forms and can be expressed in multiple ways.

Physically – as claims on the state, the “I promise to pay the bearer” notes; although paper makes a small (c.3%) and fast shrinking percentage of the overall stock of money, as electronic claims on commercial bank deposits (the most familiar form) and as the reserves regulated banks hold with the Bank of England (though this is only available to a few).

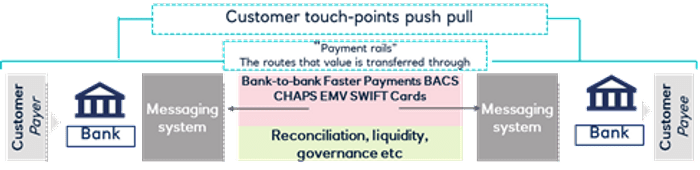

The reality is that the majority of time we are moving messages, not actual money. The diagram below breaks it down, and let’s be honest, in the main it works, and everyone seems happy(ish) with it.

… Well, most people are happy.

Truth be told the vast majority of payments revolve around “FIAT” money, which is government-issued currency that’s valid because a government issued it and tells us its value.

There is a whole economic piece that I will try to summarise (apologies to any economists reading this and please let me know if this is wrong).

Some states use capital control rules i.e., stopping you sending or taking currency out of a country or controlling the price of money with interest rate policies – a subject getting a few hearts fluttering as negative interest rates receive increasing attention. There are obviously many more factors to this, but I’m trying to keep it simple.

As the Bank of England continues its focus on digital currencies and Pay.uk upgrades its architecture some “what if” thinking is needed.

This can lead to libertarians and cryptocurrency fans arguing this is why we need a truly free floating money (like Bitcoin), protected from state interference (and all those other pesky additions like AML controls, consumer protection, governance, and economic stability etc).

But is this the right path for money? Are there other options and if so, what might they look like?

- Bitcoin (ish) but with rules to keep villains out but no control beyond the maths offered by cryptography ?

- Companies issuing their own “currency”; tradable accepted and redeemable against say future products and services …coin offerings or stablecoins ?

- Community money under regulatory control that supports local economies – Brixton pound or Liverpool local pound?

- “Online Local Money” – where local means something different, dungeon and dragon dollars for virtual worlds …the metaverse ?

- A Central Bank Digital Currency -Online Fiat Money from a central bank?

So, to make the link back from payments to money.

What if money becomes more than messaging in one currency?

As the Bank of England continues its focus on digital currencies and Pay.uk upgrades its architecture some “what if” thinking is needed.

The messaging within a merchant’s point of sale equipment is instructive; a merchant neither knows nor cares that a customer’s card may have been issued in a country they couldn’t find on a map or in currency they can’t pronounce. It just works and that’s all they need to know.

Acquirers (those who help facilitate payments acceptance) already successfully manage hundreds of different currencies so the step to manage non Fiat currencies, or a digital Fiat, may not be that far away … several acquirers already accept crypto currencies. And if we stretch our thinking as to what money and currencies could do… why not pay for your gas bill online with Avios points?

The cost to enable this is falling and we think this type of transaction represents value… a tangible satisfaction exchange… for both parties.

Final thoughts – bringing it back to the customer

Money has always evolved; technology, rule changes and changing user expectations are simply speeding up change in money and payments.

A lot of our thinking, relating to the functions of money can be traced back to Adam Smith’s Wealth of Nations. But this was published in 1776; and “technology” meant if you wanted to sign a cheque you needed to pluck a goose for a quill; our thinking needs to move on.

Changes in the form of money have implications far beyond banking and finance i.e., privacy, competition, inclusion, the role of the public sector.

As cash usage declines but digital payment volumes increase, now is the time to think about the role money could play in the future and how money and payments might evolve. What does it mean to you as a user of payments? Are you even concerned?

Changes in the form of money have implications far beyond banking and finance i.e., privacy, competition, inclusion, the role of the public sector. So, while it’s natural that discussions include financial institutions, academia, FinTechs, infrastructure and technology firms, any proposed change will require a broader debate where the views of all users, civil society groups, merchants, charities business users and consumers are represented.

Money can be so much more than it is today, what would work better for everyone? And what might the future look like?

Possible outcomes could include:

- Gentle incremental change with a few use cases being investigated; infrastructure improvements meet the needs for most segments

- CBDCs are launched and take off – they meet the needs stablecoins claim to address making them all but irrelevant

- Regulated stablecoins (Diem etc) are launched and prove highly successful – CBDCs are then launched but too late; stablecoins dominate the crypto asset space

But what do you think…?

It’s time for us to talk about more than payments and talk about money and the changing face of finance overall.

Article by:

Lee McNabb

Head of Strategy & Research, Payments

NatWest

Stay in the loop with MoneyLIVE

Subscribe to our newsletter to receive news, insights and special offers.