ARTICLE

Request to Pay: a key addition to modern-era digital payments?

The thoughts of Lee McNabb, Head of Strategy & Research, Payments at NatWest

Direct Debits were created in 1964 to make collecting payments from ice cream vendors easier. Given the state of technology and UK roads (there was only one motorway!), considerable time was required to shuttle paper between processing centres, hence the 3-day processing cycle, which over 50 years later still persists.

To be clear the Direct Debit “innovation” has proven to be a useful tool, representing a familiar and trusted way for consumers to pay regular variable bills and businesses to manage:

- Over 4.5 billion Direct Debit payments are made each year and are used by 90% of UK adults

- They allow users to ‘set-up and forget’

- Direct Debits allow amounts to vary with no-fault refunds built in

- For businesses, they’re very cost effective and they like the binary outcomes, even if they don’t like the part where a payment fails; although reconciliation files quickly show who paid and who didn’t

However…

- Over a million people in the “gig economy” have irregular income patterns

- A third of UK workers say they live “pay cheque to pay cheque to make ends meet”

- Over 40% of Direct Debit users have paid charges for bounced payments

- And ironically businesses don’t like them for making payments, preferring to retain control over when they’re debited

Moving from ‘order and pay’ to ‘pull and approve’

With 80% of the UK population owning a smart phone, close to 100% on younger segments, consumers today have more control over their digital and financial lives and are increasingly insistent that those they deal with be they utilities, the HMRC or retail businesses, (even their family and friends) be digitally-ready too. Consumers expect to be able to control what, when and how they make payments at a time and place that is convenient to them (for which read by smartphone).

Billers, on the other hand, want to leverage the potential of digital technologies, mainly to remove the costs associated with receiving payments, including the costs that occur when payments are refused.

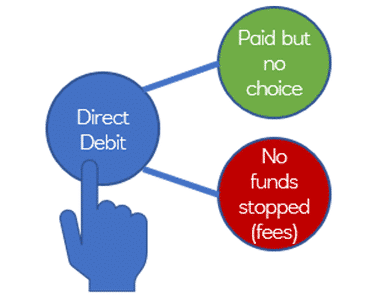

In contrast to the Direct Debit ‘order and pay’ approach, “Request to Pay” is a ‘pull and approve’ approach, where a business or an individual raises a request, which is approved by the payer before the payment is released… It’s all about choice and flexibility

This is not to suggest that Direct Debits are in terminal decline, but that there are alternatives emerging, which address the pain points of receiving payments and improve how we manage our money. With payment technologies continuing to improve, now is the time to reimagine better, more appropriate 21st century alternatives. “Request to Pay” is one such idea already making waves in several countries, and with the growth of Open Banking it has the potential to profoundly change how payments are collected whilst improving customer control and satisfaction. And it is not just something that could either replace, or indeed sit alongside Direct Debits, it can be used in peer-to-peer payments, where in the UK there has not really been one dominant proposition.

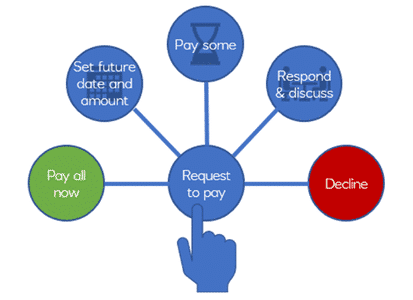

In contrast to the Direct Debit ‘order and pay’ approach, “Request to Pay” is a ‘pull and approve’ approach, where a business or an individual raises a request, which is approved by the payer before the payment is released. Additionally, as part of the build, payers have a series of options before deciding when is the right time to make (or decline) a payment, thereby putting the consumer first. It’s all about choice and flexibility.

FIGURE 1: Direct Debit options

FIGURE 2: Request to Pay brings multiple options

When customers change, you need to think about changing too

One common reason preventing change is the challenge of making business cases work – which for most firms is code for budget (Capex & Revex or internal headcount spending); all of which needs:

- a demonstrable rationale i.e. fits with the business strategy

- a business case (return on investment) that is better than other internal proposals

Therefore, some might question why they would want to change anything, especially if the current state seems (for most) to work and transformation comes with costs and limited incremental revenue or cost reduction. However, this is increasingly yesteryear’s thinking – those who fail to place customers at the heart of their strategy will struggle to realise longer-term benefits.

Take switching where comparison sites have educated users to put price above all other attributes. But as price differentiation in commoditised markets is eroded, new motives and new drivers to switch evolve. And while many issues will influence those switching, say energy suppliers, service will increasingly feature in the thinking of those 5.95 million consumers (a record high), who adopted a different energy supplier in 2020; especially if providers are all offering near identical pricing.

Request to Pay does come with some challenges. Offering Request to Pay alongside or instead of Direct Debits will change how accounts are run and will create additional credit control and servicing cost challenges where customers elect to delay payment. However, with over a million people working in the gig economy, where income and payment patterns vary from month to month, greater flexibility than that offered by Direct Debits is required. Although the majority of late or unpaid Direct Debits are eventually paid, the fees charged for delayed payments undermine customer satisfaction and will reduce customer loyalty, for banks and those raising Direct Debits.

One of the key benefits of Request to Pay (particularly for first movers) is the promise of flexibility that in commoditised markets allows firms to offer an added path to differentiate their service from peers and demonstrating a true understanding of their customers’ needs. Customers still must pay their bills but this way they do so when its best for them. In a time where finances can be volatile, and with many not knowing when and from where their next pay day will come, Request to Pay offers a helpful alternative to the current Direct Debit option.

With over a million people working in the gig economy, where income and payment patterns vary from month to month, greater flexibility than that offered by Direct Debits is required

A key part of the future Ecosystem for Digital Payments?

Finally, Request to Pay offers both payers and billers the control and ease of processing they get with Direct Debits while also providing payers with the flexibility and control of their money that they’ve been used to with manual bill payments. It can also be used as a seamless way of requesting what you are owed from friends and family, and linked with Open Banking, can mitigate some real-life customer pain points.

The triggering of real time payment messages for single or ad hoc payments offers payers receiving the payment requests:

- Control: pay when you can afford to with secure messages to your smart device

- Trust: requests arrive securely in your app from those you expect to pay

- Flexibility: could become the way we settle payments between family and friends

And means for billers or those requesting the money:

- Transparency of when the money has been requested

- Better customer service: funds collected against unique reference numbers that billers specify

- Easy: integral to your existing platforms, meaning no new integrations

The future lies with flexible payment methods such as Request to Pay, which can help to increase the flow of money across the UK and beyond. Businesses and organisations should embrace the progress of technology that can help to better meet the needs of their customers.

Article by:

Lee McNabb

Head of Strategy & Research, Payments

NatWest

While you’re here…

Check out our upcoming event!

MoneyLIVE Autumn Festival

Virtual Episodes across October & November

Broadcasting throughout October and November, our 5 virtual episodes see leading experts take to the screen and dive into the hottest topics in banking and payments, including agility and resilience, digital identities, purpose-led banking, social platforms and the future of FinTech.

Speakers include:

- Matt Hammerstein, Chief Executive Officer, Barclays UK

- Chris Pitt, Chief Executive Officer, First Direct

- Tracey Davidson, Deputy Chief Executive Officer, Handelsbanken UK

- Tom Wolfenden, Head of Retail Banking, HSBC

Stay in the loop with MoneyLIVE

Subscribe to our newsletter to receive news, insights and special offers.