There are hype cycles, and then there’s Generative AI, a technology where the hype may, over time, actually be surpassed by reality. For now, however, banks are in the foothills of this journey and are navigating uncertain terrain littered with potential pitfalls for the unprepared.

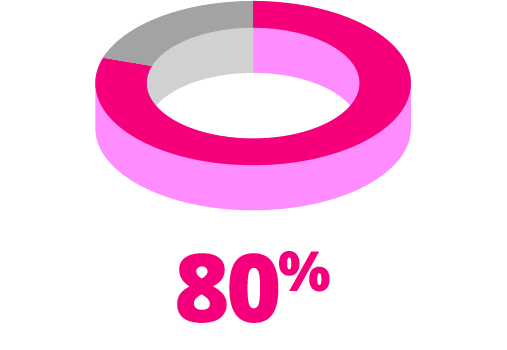

believe that unlocking value from AI will distinguish winners from losers1

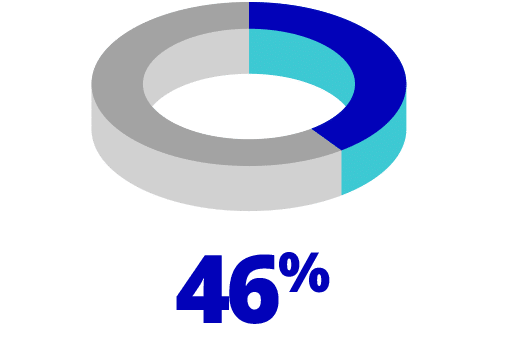

believe that incorporating AI into their organisation's products and services will help them achieve business priorities 'to a great extent'

of banks agree that complexity and risks associated with handling personal data often outweighs benefits to CX

Getting the right data to feed into the models is essential but this is a mountain all its own. Dan Kellett, Chief Data Officer of Capital One, said it’s essential to analyse and assess the entire data landscape available to the bank.

‘There’s third party data, which must be easy to onboard and must add clear value given the effort and cost involved,’ he said. ‘Then there’s the instrumentative data your organisation captures about customer interactions so you can tailor their experience, and this generates a lot of data which can ‘overawe’ you unless you have the right systems and governance in place. And then there may be overlooked data you already hold, which needs a good audit to understand but may unearth some gems.’

Hand in hand with this groundwork comes some serious strategic thinking to make sure AI projects help rather than hinder the bank’s longer-term goals. DAN KELLETT expands on this theme:

For Vinita Ramtri, Head of Conduct and Controls, NatWest, the key thing isn’t the data you hold, but what you do with it.

Work out who is accountable. If you say everybody is accountable then we all know everybody means nobody. You need someone who has ownership and once you have that, the management is easy.

VINITA RAMTRI

HEAD OF CONDUCT AND CONTROLS,

NATWEST

Indeed, putting the customer at the heart of this journey is seen as key to not only make sure there’s purpose and value in all this investment but also to stay the right side of regulators, who are now scrabbling to keep pace with this accelerating technology. Both Kellet and Ramtri agreed that the UK’s Consumer Duty regulations were a helpful guiding star in this process.

‘We need to make sure we use this data to do the right thing,’ said Ramtri. ‘And we need to be able to say to the regulator we can explain our decisions and we took reasonable steps so the customer can make an informed choice.’

Indeed, making sure the outputs of AI are explainable – known as XAI – is going to be key. Here, Luke Vilain, Generative AI Risk Assessment Lead at a leading financial services group, was able to provide some insights.

‘We need to be having C-Suite conversations about AI ethics,’ he said, identifying key concerns as the EU AI Act, and the potential future legal pitfalls around the training of LLMs. ‘As banks we are regulated to within an inch of our lives,’ he noted, stressing the importance of taking AI ethics, explainability and bias very carefully now before letting these models loose across the organisation.

Get this right, and a journey of enormous possibilities lie ahead.

Stay in the loop with MoneyLIVE

Subscribe to our newsletter to receive news, insights and special offers.

By submitting this form you agree to our Privacy & Cookies Policy and Terms & Conditions