The ‘Open’ agenda has come a long way since PSD2 came into force in 2018. Designed to increase competition and drive innovation on behalf of customers, the Directive is now into its next iteration, PSD3, to extend this disruptive agenda to other financial products such as savings, lending, mortgages and insurance.

It’s a brave new world – but it doesn’t come for free. Having worked hard and made substantial investments to achieve Open Banking compliance, banks are now grappling with how to monetise the APIs that not only act as the digital glue of these new open ecosystems but increasingly are fully-fledged services in their own right.

It’s a brave new world – but it doesn’t come for free. Having worked hard and made substantial investments to achieve Opening Banking compliance, banks are now grappling with how to monetise the APIs that not only act as the digital glue of these new open ecosystems but increasingly are fully-fledged services in their own right.

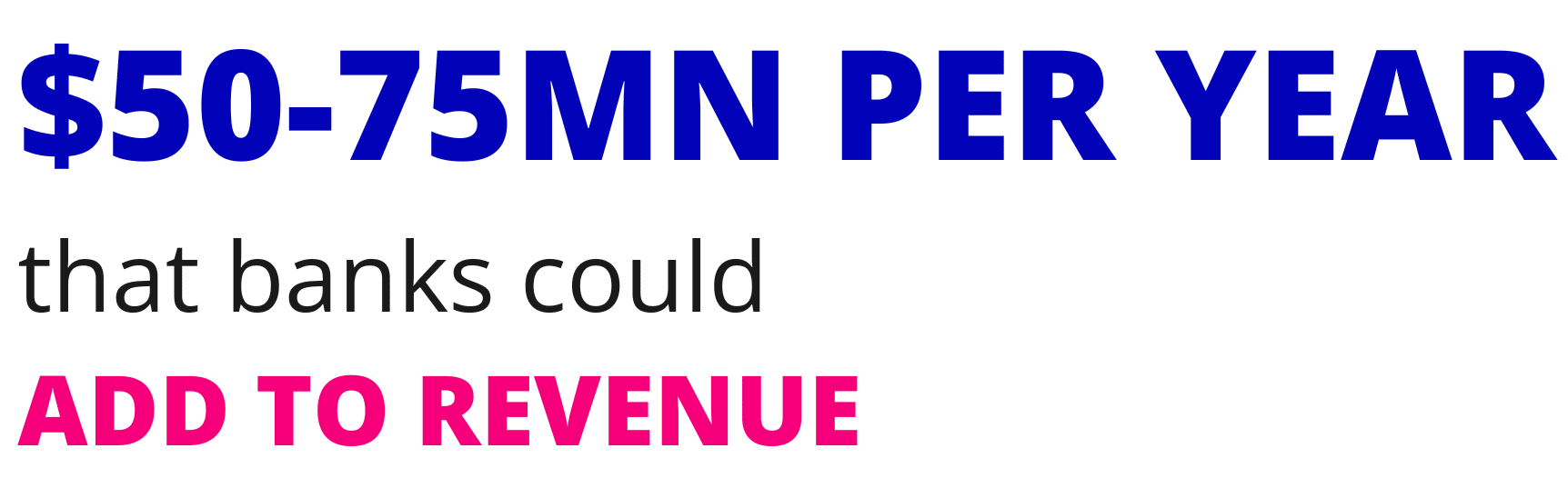

$50-75MN PER YEAR

that banks could

ADD TO REVENUE

Monetisation is as much about having an ‘API mindset’ as it is putting in place the technology, said Joris Hensen, Founder and Co-Lead of Deutsche Bank API Program, Deutsche Bank.

‘It’s about the discipline of using APIs,’ he said, highlighting the bank’s global API platform. ‘Banking-as-a-service requires groundwork.’

Indeed, Deutsche Bank has opened a new revenue stream under Joris’s leadership: its dbAPI platform is a successful example of B2B API commercialisation, allowing brands to connect with Deutsche Bank data for a fee.

An API mindset will also help banks think ‘beyond banking’, allowing them to carve out new revenue streams by offering value-adding products and services to meet the unmet needs of existing customers, or reaching currently underserved customer segments, such as SMEs and vulnerable customers.

Banks also need to think about wider financial data they can tap into from other institutions, such as the DVLA, HMRC and Companies House.

[This wider financial data] could unlock some really valuable use cases in terms of KYC, ID verification and income verification. But we’d need to incentivise data holders to share this data.

GEORGE MILTIADOUS

Head of Open Banking Delivery, UK, HSBC

This means generating products and services that add real value to customers’ lives. Our speakers highlighted a range of potential use cases, from speeding credit approval to helping people save for retirement.

‘There’s a crucial opportunity around using Open Banking to democratise financial advice,’ said Paul Mullins, formerly the Managing Director of Global Strategic Initiatives, at HSBC. He added that it’s not just widening access to advice but to a wide range of financial products and services to customers who may not fit the standard banking model. Custom Credit, for example, is a FinTech that uses Open Banking to provide customised personal loans with a flexible payment schedule to accommodate those customers who may have irregular income and expenditure.

So, against this background of myriad opportunities, how should banks go about defining a strategy for building APIs products?

Joris Hensen, Founder and Co-Lead of Deutsche Bank API Programme, Deutsche Bank tackled exactly this question at MoneyLIVE Summit

The backdrop to this ongoing disruption, of course, is the as yet unknown intent of Big Tech players, such as Apple and Google, which have data capabilities beyond most banks and could be tempted into this space by the levelling of barriers to entry by the regulators. The MoneyLIVE jury was still out on this, with speakers carefully watching Apple’s moves as a potential signal of the competitive storm clouds that may lie ahead. For now, however, Samantha Seaton of Moneyhub urged players in the financial services space to ‘make hay while the sun shines’.

Stay in the loop with MoneyLIVE

Subscribe to our newsletter to receive news, insights and special offers.

By submitting this form you agree to our Privacy & Cookies Policy and Terms & Conditions