Innovation ignited

Europe's most senior banking and payments event

10-11 March 2025 | Business Design Centre, London

2024's event sold out; book early to confirm your place for 2025!

MoneyLIVE Summit sets the agenda for the future of banking and payments.

Hosted in the FinTech capital of the world, MoneyLIVE Summit is the global payments and banking event bringing together industry leaders at the top of their game. This is where ground-breaking partnerships are forged, where innovation is accelerated and where the brightest ideas are born.

2025 CONFERENCE SPEAKERS

Take inspiration from our supercharged speaker line-up at this year's banking and payments event.

“An unmissable event for those serious about banking and payments transformation.”

Global Head of Strategy & Innovation, ING

WHAT YOU CAN EXPECT

Best-in-class Content

Join us for 5 stages of carefully curated content on the issues at the cutting-edge of banking and payments transformation. From lending innovation, Digital ID and financial crime, AI and operations, next-gen CX, open banking commercial models, SME banking, merchant payments, digital currencies and beyond.

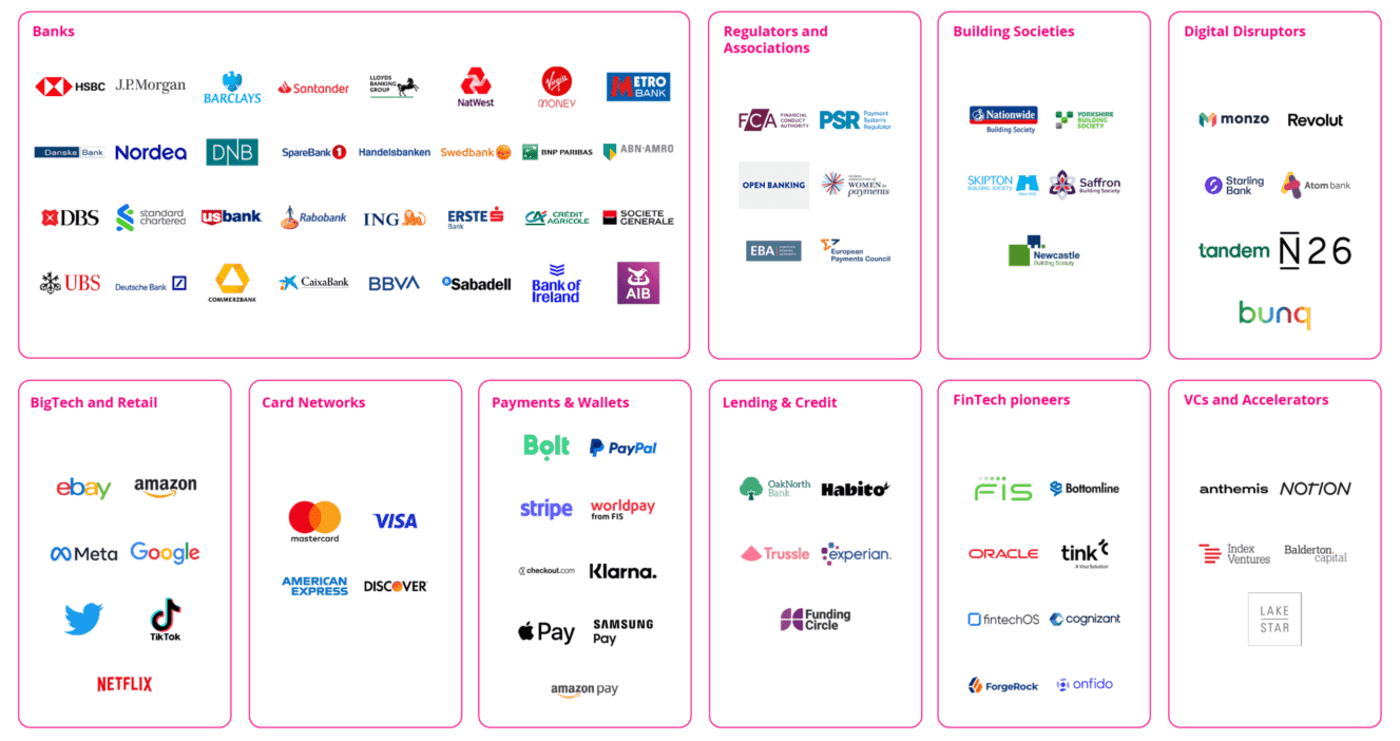

Global Ecosystem

We gather the banking and payments ecosystem under one roof. From Tier 1 banking titans to up-and-coming challengers, key regulators and policy setters to BigTech and wallet disruptors. This is your chance to gain unparalleled access to the players driving progress within the industry.

CEO Central

At MoneyLIVE we bring you the most innovative leaders with C-suite speakers from Revolut, HSBC, Santander, NatWest, Bunq, Tandem, Atom Bank and more. Gain exclusive take-home insights into the lessons behind their success, and learn how senior decision-makers are grappling with the key strategic challenges of today.

Powerful and Influential Conversations

At MoneyLIVE we drive the conversations that keep the commercial world turning. Get stuck into 1-2-1 meetings, collaborative workshops, thematic roundtables, structured networking and the relaxed after party where you can strike up a connection with an audience that is 60% C-Level, Director, VP or Head-of level.

STARTUP CITY

Welcome to Startup City, the innovation epicentre of

MoneyLIVE Summit 2025. This designated hub is designed

to accelerate start-up and scale-up growth, featuring a

dynamic stage, exclusive networking zone, and high-impact

deal booths.

If you’re on the hunt for funding, seeking scaleup

opportunities, or looking to forge distribution partnerships,

you’ve found your ultimate arena.

Key themes

Payments Innovation

• Open banking payments

• Google Pay case study

• Cross border payments

• ISO 20022 and instant payments

Digital ID and Financial Crime

• EU Digital Identity Wallets

• AML and perpetual KYC

• Preventing APP fraud

• Fraud, Analytics and AI

Operations and Legacy Modernisation

• Streamlining workflows with AI

• Cloud migration strategies

• Data maturity roadmap

• Modernising core banking systems

Customer Experience and Engagement

• Protecting vulnerable customers

• The AI revolution in CX

• Next-gen personalisation

• Customer strategic priorities

Consumer Lending

• AI in credit risk modelling

• Optimising collections and recoveries

• Embedded lending strategies

• Orchestrating the housing ecosystem

Open Banking and Open Finance

• NatWest Boxed: BaaS case study

• The Future Entity: latest from OBL

• FIDA and Smart Data Roadmap

• New commercial models

Building Societies

• Mortgage product innovation

• Seamless mortgage journeys

• Mobile app development

• Defining your digital strategy

Startup City

• Founders Q&A

• Scale-up strategies

• Cross border expansion

• Partnership pain points

Our MoneyLIVE Summit Advisory Board

Our advisory board helped to steer 2024’s agenda to reflect the most pressing issues in the market.

Paul Horlock

Paul Horlock, Chief Payments Officer at Santander UK, oversees a unified UK Payments team collaborating with the European region under One Santander.

Des Moore

With nearly 40 years in retail and commercial banking, Des has led The Cumberland through significant transformation for 3.5 years, focusing on sustainability for Customers, Communities, and Colleagues.

Christopher Hunter

Chris Hunter, N26’s Global Head of Executive & Business Recruiting since 2020, oversees senior leadership team expansion in various functions like marketing, people, operations, legal, and banking.

Kevin Mountford

With 30 years of experience in senior management and executive roles, Kevin has worked with prominent UK brands like Bank of Scotland, HBoS, and Birmingham Midshires.

Conrad Ford

Conrad Ford, Chief Product Officer at Allica Bank, heads one of the UK’s Top 20 fintech firms according to The Times.

Agenda at a glance

Take a look at the hot topics at this year's banking and payments event.

Day 1

____

STAGE 1

Banking strategy and innovation

CEO keynotes

Revolut case study

Leaders Forum panel discussion

Startup City

Founders' journeys panel and Q&A

STAGE 1

Banking strategy: the key drivers

Chief Economist forum

Navigating regulatory and policy change

Challenger bank growth strategy

STAGE 2

Payments infrastructure

Cross border payments

ISO 20022

Instant payments

Modernising architectures

STAGE 3

Digital ID and authentication

EU Digital Identity Wallets

The Large-Scale Pilots

Digital ID and fraud

Next-gen authentication

STAGE 4

AI and operations

AI case study

Streamlining workflows

Coding and software development

Optimising operations

STAGE 5

Workshop:

vulnerability and accessibility

Achieving digital excellence for all

Group discussion

Startup City

Green transition opportunities

Innovative SME solutions

STAGE 1

CX and engagement

Protecting vulnerable customers

The AI revolution in CX

Personalisation

Customer strategic priorities

STAGE 2

Open banking payments

The latest on the SPAA

A2A global successes

Commercial propositions

STAGE 3

Anti-financial crime

Vulnerable customers

AML and perpetual KYC

Preventing APP fraud

Data, analytics and AI

STAGE 4

Legacy modernisation

Creating the agile bank

Cloud migration

Data maturity roadmap

Core modernisation

STAGE 5

Workshop:

AI governance

Establishing effective AI governance

Group discussion

Startup City

Scale-up strategies

Cross-border expansion

STAGE 1

Consumer lending

Orchestrating the housing ecosystem

AI in credit risk modelling

Optimising collections

Embedded lending strategies

STAGE 2

Payment wallets and cards

Google Pay case study

The latest on the EPI's Wero

Adding value to cards

Alternative payment methods

STAGE 3

Resilience and security

Navigating global regulation

IT security to third party risks

AI and cybersecurity

DORA compliance

Startup City

The venture capitalist view: what to look for in a winning start-up

Overcoming partnership pain points

The Official After Party

Day 2

____

STAGE 1

Open banking commercial models

NatWest Boxed: BaaS case study

The Future Entity: latest from OBL

Premium APIs and BaaS commercial models

Startup City

Identity and fraud solutions

Empowering future generations

STAGE 1

Open finance

FIDA: open data in Europe

The UK smart data roadmap

Future of open banking, insurance and pensions

Open data beyond finance

STAGE 2

Optimising payments for merchants

Evolution of eCommerce

One-click payments

SoftPoS and self-checkout

Acquirer propositions

STAGE 3

Building Societies: mortgage innovation

High LTV product innovation

Seamless mortgage journeys

First-time buyer market

Product strategies

STAGE 4

Green Transition

Modelling and mitigating climate risk

ESG compliance: data and reporting

Green financing innovation

StartUp City:

Bank Workshop

Bank participants will identify a pain point from their own organisation to generate a problem statement for start-ups to address

STAGE 1

Digital currencies and blockchain

The digital euro

The regulated liability network

Smart contracts

Commercial and central bank digital currencies

STAGE 2

Better serving SMEs

The SME banking experience

Streamlining corporate onboarding

Treasury management

SME lending

STAGE 3

Building Societies: digital strategy

Mobile app development

Digital transformation case study

Defining your digital strategy

End of conference

Who attends

Check out who will be attending this year's banking event.

AFTER PARTY

Network the night away!

This is where those all-important conversations happen. Join us and raise a glass to new connections, opportunities and a show to remember. Who knows where a conversation might lead?

Conference tickets

The more you buy, the more you save

Group of 5+

Financial services*

Save 20% on tickets when you book a group of 5+

Group of 3+

Financial services*

Save 15% on tickets when you book a group of 3+

Group of 3+

Standard*

Save 15% on tickets when you book a group of 3+

Book before 6 December 2024 for an Early Bird discount

Financial Services*

£1,199.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

Standard

£2,149.00 +VAT

Tickets include:

✓ 2 days of content across 5 stages

✓ Access to the virtual networking app

✓ Catering, including lunch and refreshments

✓ Our best ever After Party

You are purchasing tickets at the Rate

Start-up Rate

Do you work for a start-up at seed-stage, that has < £5 million in annual revenue, and has been in business < 5 years? If so, you can apply for the start-up rate to attend MoneyLIVE Summit and a member of our team will get in touch.

Press Passes

Are you an accredited member of the press? Do you work for a publication seeking new partnership opportunities? Apply today to see if you are eligible for a complimentary press pass to attend MoneyLIVE Summit.

THE VENUE

We’re moving!

To accommodate our growing community we’re heading to the Business Design Centre!

We’re curating a space like no other for this year’s show. Immerse yourself in a high-energy environment that will leave you feeling motivated and inspired.

Sponsorship options

Explore options for sponsoring our banking event.

Thought leadership

Taking part in a fireside chat, fielding a chair or participating in a panel discussion alongside industry leaders are just some of the thought-leadership opportunities for you to showcase your insight and expertise.

Brand awareness

You want to ensure your brand is front of mind with senior players in the banking and finance world. Using multiple channels across MoneyLIVE, we have the megaphone to tell your story and increase visibility of your brand.

Lead generation

We get industry leaders, you form lasting connections with those who have genuine buying power. From 1-2-1 meetings via a VIP concierge, to bespoke roundtables, the opportunities are endless.

Why sponsor?

MoneyLIVE Summit will bring together key stakeholders from across the banking and payments landscape.

MoneyLIVE Summit is the place to connect with finance leaders where there will be lots of opportunities to facilitate collaboration, develop robust strategies and keep the wheels of innovation turning.

Our main focus is making sure that the banks are in the room and that we put senior decision-makers in front of your sales team.

Don’t just take our word for it!

Watch the video to hear what our MoneyLIVE series sponsors had to say…

2024 Event Sponsors

Headline Sponsor

Publicis Sapient

Platinum Sponsors

FintechOS

Gold Sponsors

LexisNexis Risk Solutions

Personetics

Thales

Silver Sponsors

Bronze Sposnors

nsKnox

Webex by Cisco

Education Partner

Media Partners

Cointelegraph

Financial IT

FinTech Power 50

Mobey Forum

The Fintech Times

The Paypers

Ai-powered Networking

150+ MEETINGS | 500+ CONNECTIONS | 1000+ MESSAGES

Benefit from:

- The AI matchmaking tool

- Search, sort and filter the full attendee list

- Instant messaging

- Book and accept meetings

- Build your own personal agenda

“MoneyLIVE consistently delivers the most exciting banking content and the most engaging speakers.”

Head of Customer and Market Insight,

Virgin Money

MoneyLIVE Summit 2024 was one to remember, check out this year's highlights...

#MLSUMMIT25

Get in touch

By submitting this form you are agreeing to our Privacy & Cookies Policy.